Paying for college

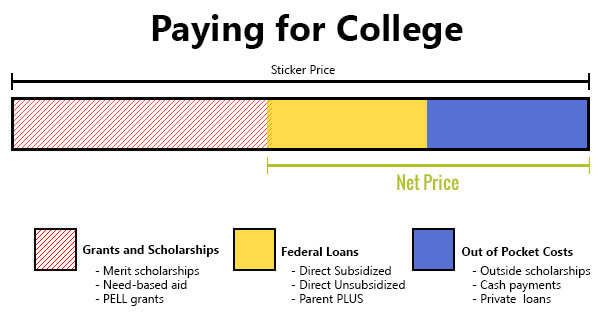

You need to understand the difference between sticker and net price before understanding how paying for college works.

The amount left after you factor in merit and talent scholarships for the college, need-based aid from the college, and any federal grants for which the student may qualify is your net price. It isn’t necessary to pay back or finance the amount either. The amount is generally free money taken right off the top of your college bill. (You may need to meet certain academic or financial criteria to qualify for the aid each year you’re enrolled).

The net price is what you’re actually paying for college—either in loans or cash.

Once you have a net price figure, ask yourself: How much could your family afford to pay out of pocket? Any money put toward paying for college now will save money on student loan interest in the later. Consider even the effect of $500 per semester—that’s $4,000 over four years you won’t need to borrow.

The remaining balance can be paid in a number of ways. There are many federal loan programs. For example, subsidized and unsubsidized student loans, or Parent PLUS loans. If you aren’t able to pay the net price out of pocket, then this is probably the best way to finance education. Federal loan programs usually have much lower interest rates than other options. When you receive award letters from your college, it will explain exactly how much you’re eligible to receive from these programs.

After that, it comes down to two options. Either outside scholarships (sponsored by businesses and organizations) and private loans.

As a student or parent, your goal is likely to minimize the amount you need to borrow in private loans. They tend to have high interest rates and high default rates. But, there are many options available to pay college before getting private loans.

Getting a preliminary net price estimate

Start with a net price estimate and get a good idea of how you’ll pay for college.

Notice that I say estimate. No one can tell you exactly what your net price will be until you’ve applied, completed a financial aid application (the FAFSA), and received an official award letter.

But, you can use the College Raptor search to get an estimated net price for every 4-year college. You can use this at the beginning of your search to get an idea for some of your options. Alternatively, if you’ve already started your search, you can use it to compare the colleges you’re already considering.

Almost every college is also required to have a net price calculator on their website. You can use these to get an estimate for a college or university.

Doing your homework early really beats getting blind-sided when your child is about to head off to college. It’ll help you strategize about an appropriate mix of schools academically and financially.

Financial aid and unique family circumstances

The Federal government’s financial aid application form, the FAFSA, is an attempt to put every American family on a level playing field in an effort to award aid fairly.

What happens, however, when the FAFSA does not adequately allow you to express your family’s unique financial circumstances? How do you communicate this important information and to whom do you send it? Imagine trying to send this to the feds.

Rest assured, someone is out there to listen to you, but knowing what to tell them and who to tell in your most patient and persistent fashion will undoubtedly be the key to being heard.

Financial Aid Administrators (FAA’s) at individual colleges have the authority to make “professional judgment” changes to the info you submit on the FAFSA. They are the only ones who may make the changes and they may only do so with proper documentation from you.

So, first, when you file the FAFSA, answer the questions exactly as indicated. Give them what they ask for and only what they ask for. Once the requisite application forms are complete, write a letter documenting your individual situation using precise dollar amounts and dates, where applicable, and send it to a financial aid officer at one or more colleges.

An example will illustrate:

The FAFSA asks for your financial information for the last full calendar year prior to when your child starts college. If your child begins college in September 2018, you’d use your 2017 taxes. Use your 2017 tax return to get a good idea of your 2018 income. But, let’s say you got laid off in January 2018. Your tax return isn’t a good indicator anymore. You fill in the FAFSA as instructed anyway, even though the numbers no longer reflect your current financial situation.

After that, you write a letter to the schools your child applied to. Addressing the financial aid office, you include the date you were laid off and how much you earned year-to-date prior to that. You also indicate how much unemployment compensation you get per week, as well as the number of weeks you’re eligible to receive such compensation. If you have a job lined up, include that, as well as the income figures. If you don’t have something lined up, let the office know that too. Now, the financial aid office has the best idea of how your finances are looking for the year.

Each school can make adjustments as they see fit. However, you need to give them the necessary facts.

The most challenging part is being persistent. You want your letter to get to someone who can give time and attention. That means making follow up emails or phone calls. Maybe even enduring long hold times. But take it from someone who spent years on that side of the desk. Polite patience and persistence will pay off.

| Lender | Rates (APR) | Eligibility | |

|---|---|---|---|

|

5.99%-16.61%* Variable

4.24%-15.61%* Fixed

|

Undergraduate and Graduate

|

VISIT CITIZENS |

|

5.37% - 15.70% Variable

3.99% - 15.49% Fixed

|

Undergraduate and Graduate

|

VISIT SALLIE MAE |

|

5.37% - 17.99% Variable

3.79% - 17.99% Fixed

|

Undergraduate and Graduate

|

VISIT CREDIBLE |

|

5.98% - 13.74% Variable

3.99% - 12.61% Fixed

|

Undergraduate and Graduate

|

VISIT LENDKEY |

|

5.99% - 15.85% Variable

3.79% - 15.41% Fixed

|

Undergraduate and Graduate

|

VISIT ASCENT |

|

3.70% - 8.75% Fixed

|

Undergraduate and Graduate

|

VISIT ISL |

|

5.62% - 16.85% Variable

4.17% - 16.49% Fixed

|

Undergraduate and Graduate

|

VISIT EARNEST |

|

6.00% - 14.22% Variable

4.50% - 14.22% Fixed

|

Undergraduate and Graduate

|

VISIT ELFI |

I actually read this report and it is a great report and very informative.