If you’ve just started your college search, you may be shocked to discover that the cost of attendance at your dream school is tens of thousands of dollars per year outside of your price range.

How does anyone afford college at this price?

Very few students pay the sticker price to attend college

Nearly all students receive some form of financial assistance to help pay for college. In many cases, this aid takes the form of grants–either federal, state or institutional (from the college or university). Grants are essentially “free money”, or a discount on your cost of college.

Nearly all students receive some form of financial assistance to help pay for college. In many cases, this aid takes the form of grants–either federal, state or institutional (from the college or university). Grants are essentially “free money”, or a discount on your cost of college.

Grants and scholarships are awarded to students based on financial need or for merit (meeting certain academic criteria, sports or other activity-related scholarships) respectively.

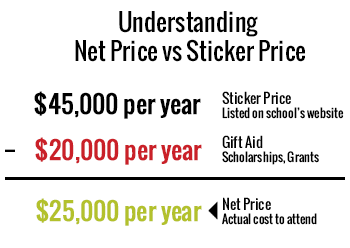

The price of a college after taking these grants and scholarships into account is called the “net price”.

For many students, the net price of a college is significantly less than the sticker price of that institution.

The majority of grant aid is awarded based on a family’s degree of need and price range

This aid comes from the government, usually in the form of Pell grants or, most often, as a grant or scholarship from the college.

Even the country’s priciest private colleges can be affordable to students from low-income backgrounds. In fact, private institutions tend to give significantly more grant/scholarship aid than public universities. So, while their sticker price may appear to be much more expensive, private colleges can often turn out to be comparable to public colleges for most families or even cheaper in some instances.

You won’t know your exact net price at a college until you’ve been accepted and received your financial aid package.

College Raptor can predict your net price for every four year college in the United States based on the financial and academic information you provide. This can help you decide where to apply.

Scholarships are not just for A+ scholars or athletes–and you don’t always need to “win” them

Many colleges offer scholarships for different ranges of students.

Sure, better grades and special talents may qualify you for additional money, but chances are that a school looking for a student just like you will offer you a generous aid package.

But, even more importantly, most of these scholarships are not awarded to just one student who is lucky enough to win. Much of the merit and need-based aid given to students is awarded based on simply meeting certain qualifications. By just meeting certain requirements–and usually maintaining a certain GPA in college–you can qualify for this aid by simply attending that college or university.

All of this means that you shouldn’t rule out the college of your dreams–there’s a good chance it’s more affordable than you think.

How College Raptor helps you find the best scholarships and grants

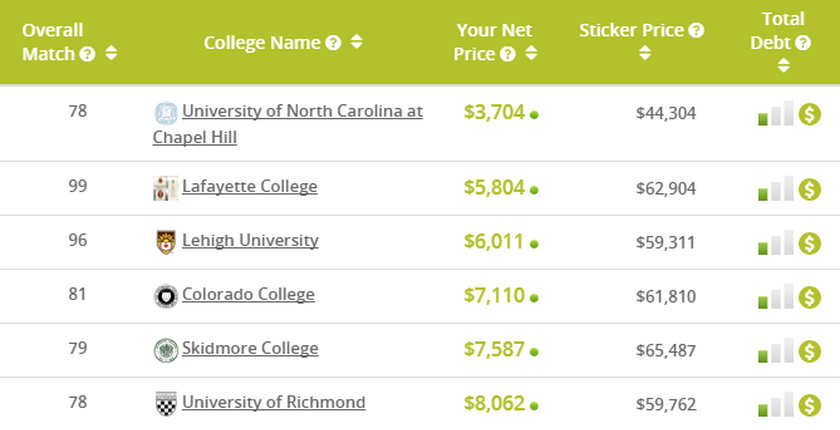

The College Raptor match tool was created to match students with colleges that are a good fit academically and culturally, but also most likely to offer them big scholarships and grants to pay for college.

In just a few minutes, a student can get a customized list of college matches, plus see how their price could be dramatically less than the full cost. This price–after scholarships and grants are considered–is called your “Net Price”, and it’s what you actually pay (either with loans or out of pocket).

Here’s an example:

This is just one student’s results, but it’s not uncommon. Most students using College Raptor find that schools they thought were “way too expensive” are actually much more affordable.

Give it a try! You’ll probably be pleasantly surprised to find out just how affordable some colleges might be for you.

| Lender | Rates (APR) | Eligibility | |

|---|---|---|---|

|

5.34%-15.96%* Variable

3.99%-15.61%* Fixed

|

Undergraduate and Graduate

|

VISIT CITIZENS |

|

4.92% - 15.08% Variable

3.99% - 15.49% Fixed

|

Undergraduate and Graduate

|

VISIT SALLIE MAE |

|

4.50% - 17.99% Variable

3.49% - 17.99% Fixed

|

Undergraduate and Graduate

|

VISIT CREDIBLE |

|

6.00% - 13.75% Variable

3.99% - 13.75% Fixed

|

Undergraduate and Graduate

|

VISIT LENDKEY |

|

5.50% - 14.56% Variable

3.69% - 14.41% Fixed

|

Undergraduate and Graduate

|

VISIT ASCENT |

|

3.70% - 8.75% Fixed

|

Undergraduate and Graduate

|

VISIT ISL |

|

4.99% - 16.85% Variable

3.47% - 16.49% Fixed

|

Undergraduate and Graduate

|

VISIT EARNEST |

|

5.00% - 14.22% Variable

3.69% - 14.22% Fixed

|

Undergraduate and Graduate

|

VISIT ELFI |