Someone once accurately explained college pricing and financial aid with this anecdote:

Someone once accurately explained college pricing and financial aid with this anecdote:

You live in the Northeast quadrant of the United States. The temperature outside could be displayed on one hand on any given day in January. Your little brother just dumped a quart of yellow paint on your winter coat—meaning you need to buy a new coat right now.

You go out shopping and find a stylish, warm and comfortable jacket that fits like a dream. Ready to take it to the register, you wisely ask, “How much does this little beauty cost?”

You’re mid-stride when the salesperson takes a deep breath and says, “Well, that depends. First, you’ll have to fill out paperwork that asks you to detail your family’s financial situation. We’ll send that information off to the government, and they will tell you what THEY think you can contribute to the cost of this coat. This information will then go to our manager. They will determine whether or not he can offer you enough financial assistance to make this coat affordable for you. You may also be asked to submit supporting documentation, like your taxes and a paystub. All of this will take about a month, at which point we can provide a definitive answer to your question regarding the cost of that coat.”

Luckily, this fallacious example will not doom you to a run-in with frostbite, but the parallel to college financing is undeniable.

Most families ask for the sticker price.

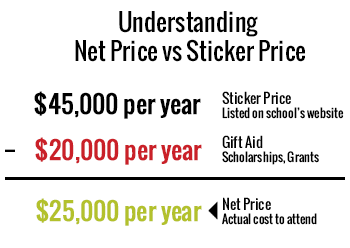

All too often, students and parents visit a college and ask, “How much does it cost to go to school here?” This, however, is really the wrong question if money matters in your college decision. Cost is the total sum of tuition, fees, room, board, and miscellaneous expenses.

What you really want to know is the net price.

The real question is, “What will this school cost me?” This number is not the sticker price listed on a college’s website—it’s the family’s net price.

The net price is a calculation based on the full price, merit scholarships and the expected family contribution (EFC). Without going into all of the math involved, suffice it to say that the calculation can be quite complex, but the end result can be wildly different on a case-by-case basis from the sticker price.

Families can use an individual college’s Net Price Calculator to get an estimate of what financial aid they’ll receive from each college, or use the College Raptor search to estimate the net price of every 4-year college in the U.S. (I would advise the latter.)

Just as students need to have schools that cover their bases academically (from safer bet to reach), you need to have this same philosophy for a financial range of schools and balance colleges that may be a better fit but not offer great financial aid with those that may be less-ideal in terms of academics or culture, but are likely to offer plenty of gift aid to offset the cost of college. This will give you more options as you determine how you’ll ultimately pay for college.

| Lender | Rates (APR) | Eligibility | |

|---|---|---|---|

|

6.97%-15.03%* Variable

5.99%-14.00%* Fixed

|

Undergraduate and Graduate

|

VISIT CITIZENS |

|

6.37% - 16.70% Variable

4.50% - 15.49% Fixed

|

Undergraduate and Graduate

|

VISIT SALLIE MAE |

|

4.98% - 16.70% Variable

4.07% - 15.66% Fixed

|

Undergraduate and Graduate

|

VISIT CREDIBLE |

|

6.07% - 11.31% Variable

4.39% - 10.39% Fixed

|

Undergraduate and Graduate

|

VISIT LENDKEY |

|

6.22% - 16.08% Variable

4.09% - 15.66% Fixed

|

Undergraduate and Graduate

|

VISIT ASCENT |

|

6.54% - 11.08% Variable

3.95% - 8.01% Fixed

|

Undergraduate and Graduate

|

VISIT ISL |

|

5.62% - 18.26% Variable

4.11% - 15.90% Fixed

|

Undergraduate and Graduate

|

VISIT EARNEST |

|

4.98% - 12.79% Variable

8.42% - 13.01% Fixed

|

Undergraduate and Graduate

|

VISIT ELFI |