Flickr user State Farm

In this guide we’ll answer the following questions:

- How can I start saving for my child’s college education?

- How can we find an affordable school?

- What’s the difference between net price and sticker price?

- Why is it important to compare financial aid packages?

- Should we consider community or online colleges?

- What if our savings aren’t enough to cover everything?

- How does the FAFSA help?

- Are scholarships and grants really the best way to pay?

- What is a work-study program?

- How do we qualify for federal student loans?

- Should we apply for private student loans?

- What are other ways to cut college costs?

College is more expensive than it’s ever been, but it’s also more important than it’s ever been. Parents want to help your student get access to quality education, but how do parents start paying for college? What are some ways to pay for college?

It all starts by understanding college costs and knowing what financial plans and options are available. We’ll break them down together—you may come to find that college can be more affordable than you thought!

College Savings Plans

The first step many parents who plan on paying for college take is to create a college savings plan. Tucking away a bit of money each month or year can help ease the cost of tuition down the road. But there are a number of different plans out there, and there’s not a one-size-fits-all option. Instead, it’s important to do your homework and find the plan that works best for your family and financial situation.

Types of Plans:

- 529 College Savings Plan: One of the most popular options. A 529 savings account offers federal (and sometimes state) tax benefits, and the money put into the account can only be used for higher education.

- 529 Prepaid Tuition Plan: A prepaid tuition plan is different from a savings plan in that it freezes the costs of tuition as an investment at the current price. This carries a risk, however. Depending on the market value of college tuition, you could end up stashing away more money than you need, or not enough.

- ESA Savings Plan: An Educational Savings Account or ESA plan is generally considered to be both more flexible and more potentially volatile than either of the 529 plans and is different than a traditional private savings plan. You have to name a beneficiary when you sign up for an ESA plan, and it is not possible to withdraw money from the plan once you deposit it.

- Private Savings Account: Another favored option is to create a private savings account and manage it yourself. This plan offers more personal control and easier access to funds but doesn’t give tax breaks.

The 2k Rule

Knowing how much to save for college can be complicated, which is why this easy rule-of-thumb was created. The rule is quite simple—start by multiplying your child’s age by $2,000. For example: Suppose your child is 10 years old, you should have about $20,000 saved up for their college education at that time. As your child grows, so should your college savings plan.

Affordable College Options

The school itself great affects the overall price tag of an education. Different schools offer different financial aid packages (aka offer letters) to help reduce the cost of attendance. The financial aid your child receives from a school can drastically change the posted sticker price, so it’s important to compare offer letters from various colleges.

A number of other factors also dictate how expensive a certain school can be—if it’s in-state or out-of-state, whether it’s private or public, the size of its endowment, if it’s online or on a physical campus, etc. Understanding the right college program for your student is the foundation for creating a college payment plan.

Net Price vs. Sticker Price

The posted cost of attendance at a college is the sticker price. This is the number that can make people think twice about even letting their student apply. For example, the current sticker price at Stanford University is just over $69,000…per year! (That’s over 275K for a four-year degree!) It’s an intimidating number, but there’s something to consider before deeming it impossible to pay for.

The net price is the actual cost paid by an individual student—aka the cost of attendance after scholarships and institutional aid have been deducted. This can drastically lower the sticker price depending on your situation. In fact, Stanford students with demonstrated financial need can earn upwards of $40,000 in institutional aid. Private colleges tend to offer their students more generous offer letters, making attendance more affordable than first glance. The net price is what you should focus on—not the sticker price. So, how do you determine what the net prices at your student’s potential colleges actually are?

Net Price Calculators

A net price calculator (NPC) is the perfect tool to see if a certain school is an affordable option for your family.

While every single college will have an NPC on their website, it can be tedious providing your information to each school your child is interested in. Save time by filling in your financial information once on College Raptor’s FREE NPC and discover a personalized net price estimate at any 4-year institution in the US!

Flickr user Moody College of Communications

Compare Financial Aid Packages

When your child is accepted into a college, they’ll receive a financial aid package (also called an offer letter). Comparing financial aid packages from different schools is incredibly important. You can weigh how much aid each school is willing to give your student against other perks or drawbacks in order to narrow down the list.

No two schools have the exact same financial aid offerings or admissions policies, so their offer letters may look entirely different. On top of that, the type of school might affect the type of aid or the amount of aid offered by quite a bit. For example, private schools tend to offer their students more in the way of financial aid to offset the higher tuition costs, whereas public schools may not offer quite as much, but typically have lower sticker prices to begin with.

If you feel your child has not been offered as much as they deserve or need, you can potentially appeal the offer letter for more aid.

Consider Some Alternate Routes

Even with the net price in mind, the overall cost can still be off-putting. But there are some money-saving alternative paths that still result in a bachelor’s degree:

Start at a Community College

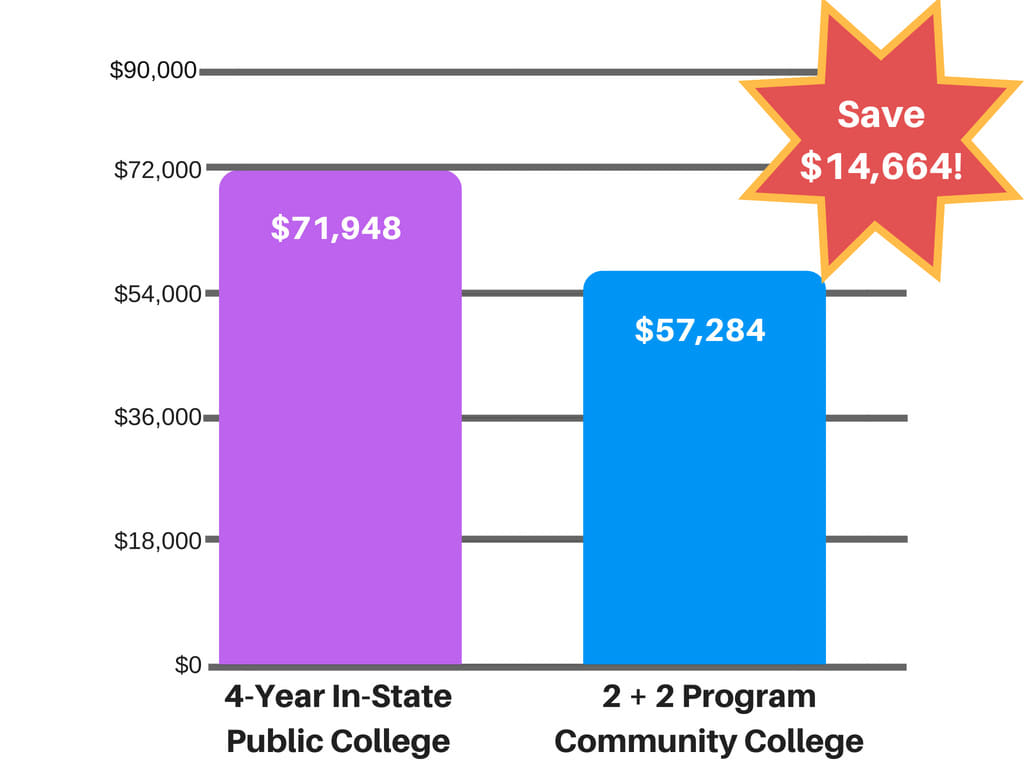

A popular alternative to consider is a 2+2 program—your student attends a community college for 2 years, then transfers to a 4-year college to finish out their bachelor’s degree. 2+2 programs are on the rise since they could decrease your educational expenses by thousands.

According to NCES, the average cost of a 2-year community college (including tuition, fees, room & board) in 2016-17 was $10,655 per year. The average cost of a public 4-year in-state college was $17,987 per year. For four full years, that cost would be approximately $71,948. But if you went to community college for two years first, it would look more like $57,284. Which is an average saving of $14,664 for a bachelor’s degree.

This method can help save not only tuition costs but housing as well–especially if the community college is nearby, then your child can just live at home and not worry about rent, which would save even more money.

Online Colleges

Earning a degree online reduces cost for travel, room & board, and more. Tuition can still be pricey, as can the required books and computer programs, but online colleges offer ways to cut costs in other areas.

Your Child Got Accepted! Now, How Do You Help Pay?

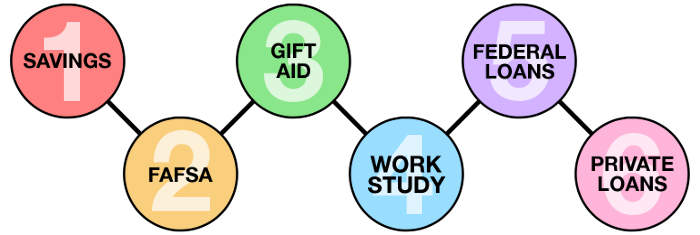

We already went over college savings plans, but what are the other ways you can help your student pay for college? Let’s go over them, and the order your family should pursue them in.

Ways to Pay for College: College Savings

Ideally, parents should start saving for their child’s education before they’re even born. Of course, life is rarely so ideal. Whether due to unforeseen circumstances or low income, sometimes families aren’t able to create a college savings plan or aren’t able to save up “enough” to pay fully out of pocket. And that’s ok, most families can’t pay the full cost of attendance on their own. If that’s the case for you, don’t panic—there are plenty of other ways to help your student pay for college.

Ideally, parents should start saving for their child’s education before they’re even born. Of course, life is rarely so ideal. Whether due to unforeseen circumstances or low income, sometimes families aren’t able to create a college savings plan or aren’t able to save up “enough” to pay fully out of pocket. And that’s ok, most families can’t pay the full cost of attendance on their own. If that’s the case for you, don’t panic—there are plenty of other ways to help your student pay for college.

Ways to Pay for College: The FAFSA

The Free Application for Federal Student Aid is the key first step in the financial aid process. Students can only be considered for federal aid by completing the FAFSA, which asks for both clerical information such as one’s social security number, confirmation of citizenship, as well as income information. This is one area your student will definitely need your help on, as your annual income and tax information plays a big role in determining financial need and your Estimated Family Contribution (or EFC).

The Free Application for Federal Student Aid is the key first step in the financial aid process. Students can only be considered for federal aid by completing the FAFSA, which asks for both clerical information such as one’s social security number, confirmation of citizenship, as well as income information. This is one area your student will definitely need your help on, as your annual income and tax information plays a big role in determining financial need and your Estimated Family Contribution (or EFC).

The form can be found online at the FAFSA site and goes live on October 1 of each year (though the submission deadline can vary depending on your home state). You’ll want to complete the FAFSA during the academic year before your student enrolls in a college, so they’ll get the aid the following year. For example, the FAFSA that opens October 1, 2018, will apply to the academic year starting in fall of 2019.

The FAFSA will outline which federal grants, state grants, and federal student loans you’re student is eligible for. The FAFSA can affect federal aid, institutional aid, and even external scholarships.

Gift Aid: Scholarships & Grants

Scholarships and grants are by far the best method of paying for college. These sources of gift aid don’t have to be repaid and can reduce the likelihood (or amount) of student loan debt.

Scholarships and grants are by far the best method of paying for college. These sources of gift aid don’t have to be repaid and can reduce the likelihood (or amount) of student loan debt.

There are plenty of scholarship opportunities available. Encourage your child to spend ample time searching and applying for as many scholarships as possible. Even smaller awards can really add up and make a big difference.

Institutional Scholarships & Grants

Colleges award their students scholarships and grants through offer letters. These financial aid packages can greatly reduce the overall cost and make that school option more affordable. In addition to some “automatic” scholarships awarded in the financial aid package, most colleges also offer some competitive scholarships. While visiting a college, be sure to speak to the school’s financial aid office and clarify any questions you may have.

Outside Scholarships

Outside scholarships can come from employers, companies, national organizations, local businesses, religious centers, ethnicity groups, and plenty more. Every scholarship earned lowers the potential for student loan debt. It’s important to note, however, that outside scholarship awards can affect how much money the college will award your student in their financial aid package. Earning scholarship money reduces your family’s financial need, after all.

Here are some great articles to help out with the scholarship search:

- How Parents Can Help Their Student in the Scholarship Search Process

- The 5 Best Websites to Find College Scholarships

- How to Conduct a Thorough Scholarship Search

Ways to Pay for College: Work-Study

Another way for students to earn money towards the cost of college is by participating in a work-study program. These programs function like part-time jobs often on campus, typically related to your child’s field of study, and the paycheck earnings funnel towards tuition costs. Work-study eligibility is often determined by financial need.

Another way for students to earn money towards the cost of college is by participating in a work-study program. These programs function like part-time jobs often on campus, typically related to your child’s field of study, and the paycheck earnings funnel towards tuition costs. Work-study eligibility is often determined by financial need.

Ways to Pay for College: Federal Student Loans

As you could probably guess, federal loans are issued and backed by the U.S. government. Federal loans differ from private loans in more than name; available funds for federal loans can be more unpredictable since they are dependent on changing government budgets for education spending. However, federal loans offer fixed interest rates that are generally lower than private loans from a bank, which can benefit students who want to save money over the life of their loan.

As you could probably guess, federal loans are issued and backed by the U.S. government. Federal loans differ from private loans in more than name; available funds for federal loans can be more unpredictable since they are dependent on changing government budgets for education spending. However, federal loans offer fixed interest rates that are generally lower than private loans from a bank, which can benefit students who want to save money over the life of their loan.

Types of Federal Student Loans

There are four main types of federal student loans:

Direct Subsidized: A loan for undergraduate students that demonstrate financial need. The U.S. Department of Education pays the interest on a Direct Subsidized Loan while the student is enrolled at least half-time.

Direct Unsubsidized: A loan for undergrad or graduate students regardless of financial need. Students are responsible for paying interest on a Direct Unsubsidized Loan while enrolled.

Direct PLUS: A loan for parents of dependent undergraduate students, or for independent graduate students.

Direct Consolidation Loans: A collection of all federal loans previously taken out that can be combined together into one federal loan.

Federal Loan Repayment Plans

There are four main types of federal repayment plans:

- Standard: Pay back the loan on a regular schedule over the course of 10 years.

- Graduated: Start by paying back with lower monthly payments that increase every 2 years.

- Extended: Pay back the loan over 25 years, with low monthly payments.

- Income-Based: The amount paid per month depends on the student’s financial income.

Federal PLUS Loans

Let’s go into a little more detail about the PLUS loans. These are geared directly towards the parents of dependent students as another way to help fund a college education. In fact, the acronym stands for Parent Loan for Undergraduate Students.

The family’s entire credit history (both past and present) will be taken into account when it comes to earning this loan. While the PLUS loan doesn’t have a hard cap, it does tend to have a higher interest rate in comparison to other federal loans. Additionally, interest starts accruing on PLUS loans right away, instead of being delayed.

Unlike other student loans, this one falls to the responsibility of the parents. There are two repayment options available: you can start repaying the loan 60 days after taking it out or wait up to six months after your student’s graduation.

Ways to Pay for College: Private Student Loans

Private loans stem from a few different sources, such as community organizations, nonprofits, corporations, banks, and even universities themselves. The interest accrued on private loans can be deducted from taxes, which can make them attractive to some families depending on their unique financial situation.

Private loans stem from a few different sources, such as community organizations, nonprofits, corporations, banks, and even universities themselves. The interest accrued on private loans can be deducted from taxes, which can make them attractive to some families depending on their unique financial situation.

Private loans should be considered a last resort for funding a college degree, as the interest rates tend to be higher and the repayment plans are less flexible. If after you’ve exhausted every other resource, it’s paramount to help your child find a loan option that best fits your situation. With College Raptor’s free Student Loan Finder, you can look at interest rates and terms from leading lenders side by side.

Interest Rates

Student loan borrowers will not only pay back the loan but also the interest that accrues every month based on the outstanding balance. For most borrowers, this interest rate is somewhere between 2–10%. Generally speaking, federal interest rates tend to be lower than private loan rates.

The rate of interest can make a huge difference in how much your child will pay not only each month, but total over the lifetime of the loan.

Small changes–like 1 or 2%–in an interest rate can add up to thousands or tens of thousands of dollars, depending on how much was borrowed and the repayment terms.

Factors that affect interest rate may include:

- Credit score/history

- Student loan payment history

- Degree

- Current and future earnings

- Savings habits

Variable Rate vs. Fixed Rate

All federal loans have a fixed interest rate, but private loans also have a variable rate option. With variable rates, the interest rate generally starts lower than fixed rates but can then go either up or down each year (depending on the index rate). Variable rates can be a gamble. If you’re lucky, your student might earn a lower interest rate, or you could be unlucky and get stuck with a higher one. This also affects payments—your child could end up paying more one month and paying less another month, or vice versa. Variable rates are generally not recommended for longer-term loans.

People looking for structure and predictability should consider fixed-rate loans. With these, what you see is what you get. Rates do not fluctuate and instead stay constant throughout the duration of the loan.

Make sure you discuss the pros and cons of each option with your student before anybody signs for a private loan.

Co-Signer Responsibilities

Most college students don’t have enough of a credit history to qualify for a student loan. Therefore, you as a parent will have to step in as a co-signer. By co-signing, you’re essentially backing your child with your own established credit, so the lender is much more willing to approve the student loan. One advantage to co-signing is that you and your child may earn a lower interest rate!

As a co-signer, you’re responsible for paying back the loan if your child can’t. If they miss a payment, or can’t pay it back after graduation, the loan falls to you. Not only can this be costly, but your credit score can also take a big hit too.

This is why it’s paramount to sit your child down and talk with them about the importance of financial responsibility, create a budget, and communicate clearly about expectations and schedules.

One easy way to ensure they make their monthly payments on time is to sign-up for auto-debit, so the payment is automatically taken from their account. It’s one less thing to worry about for them and you both.

Flickr user Matthew Prosser

Cut College Costs

There are a number of ways to cut the overall cost of college besides financial aid.

Graduate on Time

Your student taking on an extra year or two to graduate also creates extra costs—tuition, materials, housing, meals, more loans, and so on. So it’s best to graduate in four years. To achieve this goal, make sure your student works with their academic advisor to ensure classes are on track for their major and graduation requirements.

Avoid Transferring Schools

Transfer students usually add another semester or two. Requirements can change and some credits won’t transfer with them to their new college. This is another reason why it’s paramount to find the right college fit from the start. Parents are a big help when it comes to arranging college visits, having conversations about the pros and cons of each school, and offering advice.

College Credit in High School

Some high schools will offer dual credit courses, which count towards college credit hours. In essence, they’re credit hours you don’t have to pay for. Dual credits also help students graduate on time since they will be getting some credits out of the way before college even starts. Just be sure to your student stays on top of those classes in particular, as grades will show up on their official college transcript and most institutions have grade requirements to accept the credit.

Saving Money and Budgeting

Sit down and help your child plot out a monthly budget. This will help you limit spending and keep your student in financial check. For many college students, this is the first time they responsible for their own money—help them create a good healthy habit of budgeting well and sticking to the plan.

Textbooks

College textbooks can be incredibly expensive each semester. Instead of pre-ordering all of the required texts, your student should wait until after syllabus week. (Sometimes professors will decide at the 11th hour that a book may not be required after all).

If a book is required, it’s encouraged to find a used copy or online copy. Remind your student to sell back their books at the end of the semester.