Source: Flickr user pictures-of-money.

As recently as 3 or 4 years ago, financial aid had a season. It was limited and finite, but much like Christmas music that begins to play before Thanksgiving or Valentine’s Day decorations that spring up January 2nd, financial aid season has also been affected by seasonal “creep”.

It used to be that you couldn’t file a financial aid application before January 1 of the year in which you were going to begin college. So, we all just played hurry up and wait, having no clue where we stood financially until springtime, when financial aid packages were finally released from colleges and universities nationwide.

The landscape has changed, and while it may prolong the pain of filling out applications much like s-l-o-w-l-y pulling off a band aid, it actually significantly benefits families. Thanks to websites with financial aid calculators and net price calculators (like yours truly at College Raptor), you can now obtain an estimate of the college costs at any variety of schools pretty much whenever you’d like.

This means that while you’re considering your college options, you should, too, be thinking about the cost. These tools will allow you to calculate an estimate of your scholarships and your final price, which means that you can have a pretty good idea of what each school will cost way before you send in your application.

You no longer need to sit in the dark praying for some college option that is reasonably affordable.

Using the web will give you an idea of where you stand financially and you can use that information to help you plan accordingly.

Knowing whether or not you have demonstrated financial need at a school is a huge first step in knowing whether or not you’ll qualify for need-based aid (grants, loans, etc.). Each school may have its own formula for calculating and awarding aid, so it’s important to consider and compare multiple options to see what financial aid may be available to you.

If you determine that you will not qualify for need-based aid at a particular school or category of schools, you can then see if they offer merit-based aid. Some schools offer only need-based aid and not merit aid.

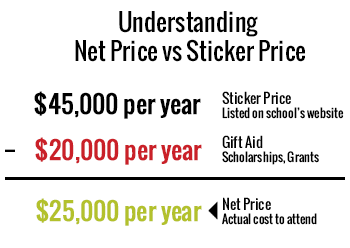

College Raptor can help you determine both the need- and merit-based aid you’ll receive from a particular school by calculating your estimated scholarship award and subsequent net price (your final price after subtracting any grants and scholarships you’ve been awarded). In other words, you can get a much better picture of how much you’ll have to pay or borrow for college just about as early in the process as you’d like.

College Raptor can help you determine both the need- and merit-based aid you’ll receive from a particular school by calculating your estimated scholarship award and subsequent net price (your final price after subtracting any grants and scholarships you’ve been awarded). In other words, you can get a much better picture of how much you’ll have to pay or borrow for college just about as early in the process as you’d like.

So, flip on the Christmas music and tune up your skis during summertime, because much like engaging in these activities off-season, you can now explore personalized college financing any time you want. Use our college match tool to see what schools best fit your financial stakes.

| Lender | Rates (APR) | Eligibility | |

|---|---|---|---|

|

6.97%-15.03%* Variable

5.99%-14.00%* Fixed

|

Undergraduate and Graduate

|

VISIT CITIZENS |

|

6.37% - 16.70% Variable

4.50% - 15.49% Fixed

|

Undergraduate and Graduate

|

VISIT SALLIE MAE |

|

4.98% - 16.70% Variable

4.07% - 15.66% Fixed

|

Undergraduate and Graduate

|

VISIT CREDIBLE |

|

6.07% - 11.31% Variable

4.39% - 10.39% Fixed

|

Undergraduate and Graduate

|

VISIT LENDKEY |

|

6.22% - 16.08% Variable

4.09% - 15.66% Fixed

|

Undergraduate and Graduate

|

VISIT ASCENT |

|

6.54% - 11.08% Variable

3.95% - 8.01% Fixed

|

Undergraduate and Graduate

|

VISIT ISL |

|

5.62% - 18.26% Variable

4.11% - 15.90% Fixed

|

Undergraduate and Graduate

|

VISIT EARNEST |

|

4.98% - 12.79% Variable

8.42% - 13.01% Fixed

|

Undergraduate and Graduate

|

VISIT ELFI |