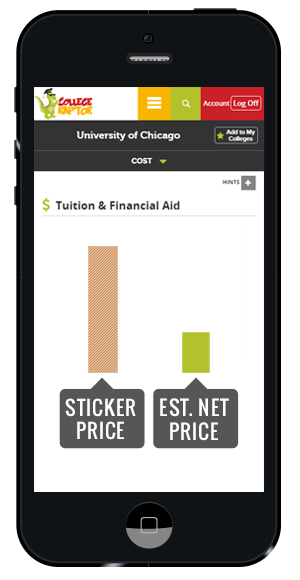

This is an illustration of the College Raptor cost details page and how it shows the difference in “sticker” price and net price.

If you’re a student looking at colleges or a parent of a student who is in the college search process, than you’ve likely been blown away by how expensive some of the price tags you see out there.

$45,000? $50,000? $60,000 per year? How does anyone afford these incredibly high tuition costs?

You may be even more disappointed to find out that many of the nation’s best private colleges and universities have huge price tags associated with them. Are these schools only for the ultra-rich and simply out of reach for you or your family?

Luckily, the answer is: Probably not.

I can’t speak for every single college and university, but by and large, many of the private colleges and universities in this country do more “discounting”–that is, they offer generous financial aid packages–which often offsets the big cost and makes these schools affordable for middle- and even low-income families.

Public colleges and universities also offer financial aid in some cases, but generally speaking, the private schools are the most likely to offer a huge discount–students pay around half price, on average.

Why College Seems to be so Expensive: Net Price vs. “Sticker” Price

The cost of college is not like the cost of a jacket or a pair of shoes. It’s not a “set” price. Instead, colleges set a maximum price and then adjust how much each student pays, based on a variety of financial and academic factors.

“Sticker” Price – The full cost of attendance published a college’s website. This price can be intimidating, but it’s often not the price that you will pay, it’s the maximum amount.

Net Price – A single student’s actual price at a specific college or university. This is the price after factoring in any grants or scholarships that will be offered from the institution itself. This is the cost that should be used to compare colleges.

So, as you can see, it’s important for you to not rely on “sticker” price as a way to determine which schools are affordable or within reach. Instead, you need to figure out what your net price will be at each college–or, which colleges will offer you the best financial aid?

Playing the Financial Aid “Game”

One of the most important things to remember: Not all colleges offer the same financial aid.

Let me say that again: Colleges do NOT offer the same financial aid.

This means that one college may offer your student or family $0 in aid, while another school may offer you a full-ride scholarship. And, that’s not just for top-tier students or athletes–it all depends on that institution’s specific financial aid rules.

Even schools that seem similar in terms of academics or prestige can offer wildly different financial aid to the same student and family.

Take this for example:

- Johnny Goodgrades has a 3.6 GPA and a 27 ACT score

- His family has an income of $80,000/year, with 4 members in the family

- He’s an Illinois resident, so qualifies for in-state tuition at Illinois schools

- For the sake of simplicity, I’ll assume that the parents have no other income or assets and Johnny has no income or assets

Here are 5 colleges he might be considering along with their “sticker” price and his estimated net price, right from each school’s net price calculator:

| College | “Sticker” Price | Est. Net Price | |

| Vanderbilt University | $63,822 | $12,354 | |

| UNC Chapel Hill | $50,360 | $20,404 | |

| University of Illinois Champaign-Urbana | $35,342 | $30,096 | |

| Augustana (IL) | $48,871 | $24,971 | |

| Loyola Chicago | $54,756 | $35,036 |

Keep in mind: The discounts you see here are not what this student “could win” in some lottery scholarship, nor are they scholarships offered for some exceptional talent. These are grants offered by the college based on their individual financial aid rules.

As you can see, his price at these schools is wildly different, despite the fact that some have similar “sticker” prices, and schools with high published costs may cost significantly less than they appear.

One college may offer a $20,000/year scholarship for any student who scores higher than a 27 on the ACT, while another school may offer zero merit aid (Stanford, Harvard, etc) and instead offer very generous need-based aid.

The challenge is for you, as a student or as a parent, to understand these different financial aid rules and be able to compare them.

Getting the Best “Deal” on College Price

So, how can you know which schools will offer you the best “deal”?

Here’s what you could do:

- Gather up a bunch of tax documents

- Go to a school’s website, search around until you find the net price calculator

- Complete that net price calculator to get an estimate of costs

- Save your results

- Go onto the next one

- Repeat, over and over and over, for every college that you want to compare

Sound a bit exhausting? Yes, yes it does.

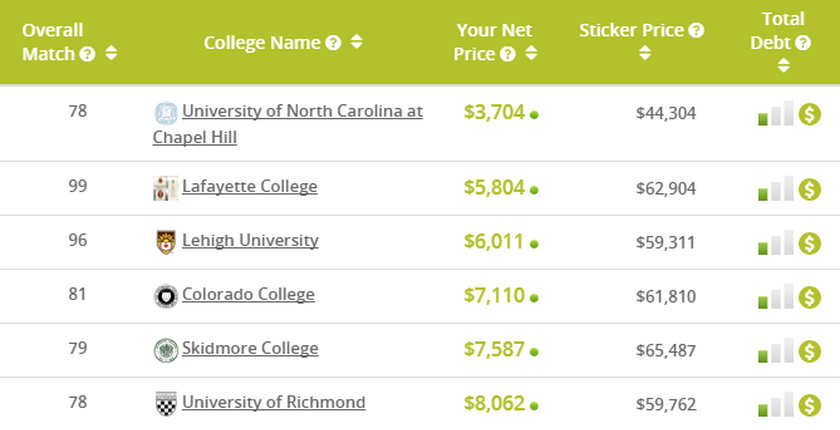

But, it doesn’t have to be quite so laborious. With College Raptor, you can get a picture of what schools will offer you the “best deal” in just a few minutes (Note that the student’s circumstances shown below are not the same as the ones above):

These results aren’t rare. As I mentioned above, many, many schools offers huge discounts to students. The key is finding which schools are the best fit for you and will offer you the best financial aid. So while college may seem expensive, it can actually be more affordable than you ever imagined.

With College Raptor, you can find these schools in just a few minutes.

Try it for yourself: Create a College Raptor account–it’s free!

| Lender | Rates (APR) | Eligibility | |

|---|---|---|---|

|

6.97%-15.03%* Variable

5.99%-14.00%* Fixed

|

Undergraduate and Graduate

|

VISIT CITIZENS |

|

6.37% - 16.70% Variable

4.50% - 15.49% Fixed

|

Undergraduate and Graduate

|

VISIT SALLIE MAE |

|

4.98% - 16.70% Variable

4.07% - 15.66% Fixed

|

Undergraduate and Graduate

|

VISIT CREDIBLE |

|

6.07% - 11.31% Variable

4.39% - 10.39% Fixed

|

Undergraduate and Graduate

|

VISIT LENDKEY |

|

6.22% - 16.08% Variable

4.09% - 15.66% Fixed

|

Undergraduate and Graduate

|

VISIT ASCENT |

|

6.54% - 11.08% Variable

3.95% - 8.01% Fixed

|

Undergraduate and Graduate

|

VISIT ISL |

|

5.62% - 18.26% Variable

4.11% - 15.90% Fixed

|

Undergraduate and Graduate

|

VISIT EARNEST |

|

4.98% - 12.79% Variable

8.42% - 13.01% Fixed

|

Undergraduate and Graduate

|

VISIT ELFI |