Accounting for inflation, the annual cost of college has more than doubled since 1980. With the average cost of attendance at private colleges now at $42,419, it’s no wonder people question the investment value and think college isn’t worth the price. Not only is the cost of college rising, many students are forced to take out student loans to afford an education. That puts students in (usually) a lot of debt once they graduate. Coupled with a tough job market, it seems like college isn’t worth it.

But research actually shows that today’s job market still strongly favors college grads over high school graduates.

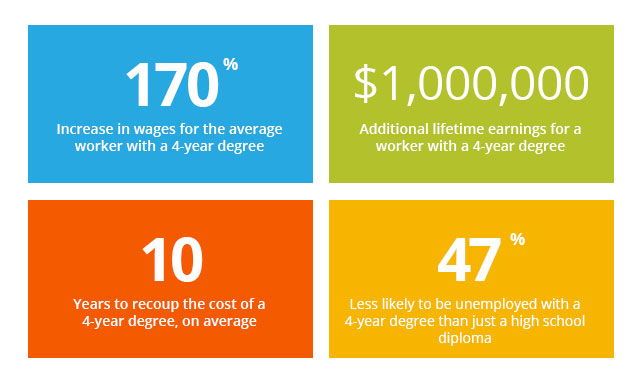

College degree return on investment (ROI)

In 2013, college graduates earned 170 percent more than workers with just a high school diploma. That’s approximately $500 more each week!

Still not convinced college is worth the price? Add that up over the lifetime — and factor in wage growth and economic opportunity — and study after study show that workers with a 4-year degree earn an extra $1,000,000 over their lifetime than workers with just a high school diploma. Despite how much you have to take out in student loans, your overall lifetime earnings technically covers that amount, and more.

Sources: NYFed.org, U.S. Census Bureau.

Liberty Street Economics showed that, today, it takes the average college grad about 10 years to recoup the cost of a 4-year degree, compared to 1980, when it took about 25 years. This means that despite many horror stories about the trouble of finding a job after college, a college degree is actually more valuable now — in terms of return on investment — than ever before. Yes, you will be taking on a lot of debt initially, and you may have to put off larger financial purchases (such as buying a house), but you’re most likely going to be able to pay off your loan.

College degrees reduce unemployment

Further, possessing a bachelor’s degree means you’re at least 47 percent less likely to be unemployed than your high school diploma counterparts. Many jobs are looking for people with at least a bachelor’s degree, no matter what you majored in. Most likely, students want a job relevant to what they studied in college. Even if you can’t find a job that perfectly fits your college major, there are still other jobs that you qualify for and could actually use what you learned in other ways.

By nearly every measure, a college degree will pay for itself, and in less time than it used to take.

So, is college worth the cost?

Absolutely. Even an expensive education will easily pay for itself over the course of your career. But, it’s an investment and that means that it will take some time before you feel all the benefits.

Don’t enroll in a college or university without researching cost and fit, and don’t go to college just to go through the motions. Use your higher education as a way to prepare yourself for a career. Discover your strengths and passions, gain experience that will help you get hired and plan a path forward.

| Lender | Rates (APR) | Eligibility | |

|---|---|---|---|

|

5.34%-15.96%* Variable

3.99%-15.61%* Fixed

|

Undergraduate and Graduate

|

VISIT CITIZENS |

|

4.92% - 15.08% Variable

3.99% - 15.49% Fixed

|

Undergraduate and Graduate

|

VISIT SALLIE MAE |

|

4.50% - 17.99% Variable

3.49% - 17.99% Fixed

|

Undergraduate and Graduate

|

VISIT CREDIBLE |

|

6.00% - 13.75% Variable

3.99% - 13.75% Fixed

|

Undergraduate and Graduate

|

VISIT LENDKEY |

|

5.50% - 14.56% Variable

3.69% - 14.41% Fixed

|

Undergraduate and Graduate

|

VISIT ASCENT |

|

3.70% - 8.75% Fixed

|

Undergraduate and Graduate

|

VISIT ISL |

|

4.99% - 16.85% Variable

3.47% - 16.49% Fixed

|

Undergraduate and Graduate

|

VISIT EARNEST |

|

5.00% - 14.22% Variable

3.69% - 14.22% Fixed

|

Undergraduate and Graduate

|

VISIT ELFI |