Over 80 percent of college students met some financial aid eligibility criteria and received financial assistance during the 2011-2012 school year.

This means there is a good chance you can get financial aid.

You may think that the only way to get financial aid is to be extremely smart or a stand-out athlete. But most sources give aid to students simply because they can’t afford college without it. Most students qualify for some type of need-based aid–not just really poor students.

Your EFC determines your financial aid eligiblity

- Your family’s finances determines how much out-of-pocket you pay for college each year

Colleges and the government use your FAFSA (free application for federal student aid) information to determine your expected family contribution (EFC). This is the amount they believe is reasonable for your family to pay toward college each year. You can estimate your EFC using an online calculator.

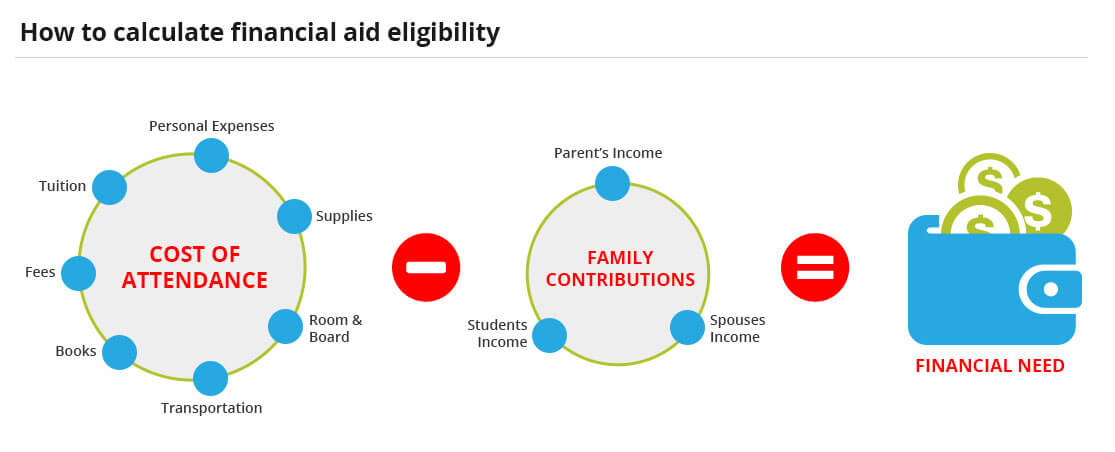

Financial need is calculated with a simple equation.

The school subtracts your EFC from a school’s cost of attendance (its sticker price), and the resulting amount is your financial need. Schools meet the need through need-based aid which comes in the form of grants, loans, or work-study jobs.

Grants are the most desirable form of need-based aid

- Grants are tax-free and don’t have to be repaid

Grant money can come from the government or a college itself. Private colleges tend to give out more grant aid than the government or public universities.

Most grant aid from the government comes in the form of Pell grants. While around a third of students receive Pell grants, most need additional support to pay for college. For 2014-2015, the maximum Pell grant amount will be $5,730.

Need-based loans may cover the rest of the cost

Students loans get a lot of negative press. But the fact is, the majority of students require some loans to afford college. in 2013, 69 percent of college graduates had some student debt.

The US government offers two need-based student loan programs–Federal Direct Student Loan Program (formerly Stafford loans) and Perkins loans. The programs differ in their interest rates and repayment periods.

Work-study aid can go toward your cost of living

- The Federal Work Study Program subsidizes your wages at a part-time job

- Schools award work-study based on need

If you’re not eligible for grant aid, you may still be able to get a work-study job. A work-study job is essentially the same as any other part-time job except the government subsidizes part of your wages.

The money you earn at a work-study job can go toward whatever you want it to, but the idea is that it will help you get through college.

The type of need-based aid you receive typically depends on your degree of need. The most in-need students will receive grants, loans and work-study. The least in-need may receive only loans.

Some aid is first come, first-served. Get your FAFSA in as early as possible to ensure you get all the aid you’re eligible for. The FAFSA opens on January 1st of every year.

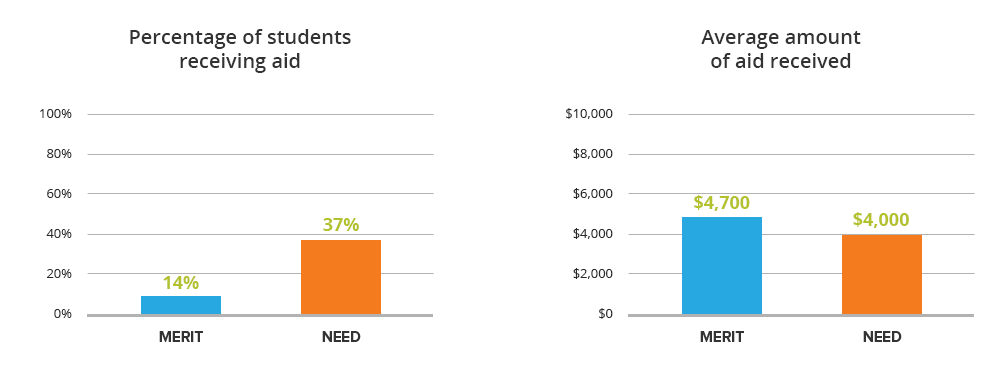

Merit-based grants are awarded to fewer students (but have higher impact)

- Merit-based aid is awarded to students because of their extraordinary talents or demographic characteristics.

Fewer students receive merit-based aid than need-based aid. However, merit-based awards are generally larger than need-based ones.

Sometimes students are considered for merit aid at the same time their applications are reviewed. Often though, a separate application process is required. You may need to do some research to determine if there is any merit-based aid you can apply for through your college.

Additional forms of financial aid

For students who don’t qualify for need-based aid but don’t have the cash on hand to pay for college, non-need based loans are available. The government, independent banks, and occasionally colleges themselves offers these loans. Students use these loans, often called “self-help” aid, when they can’t meet their EFC.

Non-need-based loans generally have higher interest rates and may begin accruing interest before graduation. Loans from independent banks may vary in amount and interest rate depending on the borrower’s credit score and assets.

| Lender | Rates (APR) | Eligibility | |

|---|---|---|---|

|

5.34%-15.96%* Variable

3.99%-15.61%* Fixed

|

Undergraduate and Graduate

|

VISIT CITIZENS |

|

4.92% - 15.08% Variable

3.99% - 15.49% Fixed

|

Undergraduate and Graduate

|

VISIT SALLIE MAE |

|

4.50% - 17.99% Variable

3.49% - 17.99% Fixed

|

Undergraduate and Graduate

|

VISIT CREDIBLE |

|

6.00% - 13.75% Variable

3.99% - 13.75% Fixed

|

Undergraduate and Graduate

|

VISIT LENDKEY |

|

5.50% - 14.56% Variable

3.69% - 14.41% Fixed

|

Undergraduate and Graduate

|

VISIT ASCENT |

|

3.70% - 8.75% Fixed

|

Undergraduate and Graduate

|

VISIT ISL |

|

4.99% - 16.85% Variable

3.47% - 16.49% Fixed

|

Undergraduate and Graduate

|

VISIT EARNEST |

|

5.00% - 14.22% Variable

3.69% - 14.22% Fixed

|

Undergraduate and Graduate

|

VISIT ELFI |