Flickr user Del

As you prepare to dive into this fall’s semester, I am sure that there are plenty of thoughts running through your head–but you are not alone. Students throughout the world are asking the same questions. What classes will you be taking? What extracurricular activities will you be participating in? Where will you be living? How will you pay for college?

Preparing for another semester of college can be a stressful time. However, it is vital that we do not allow the stress to outweigh the importance of our finances. As recent trends have caused annual tuition costs to increase by 3.4%, it is important that we understand your finances. Having financial security can significantly reduce the stress that is coupled with attending college.

So how do we gain financial control for this upcoming semester? Here are some tips to help you prepare.

Preparing College Cost For Semester

Understand New Tuition Costs

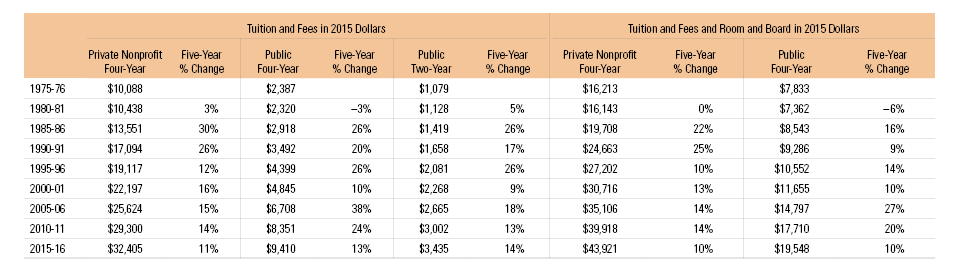

College tuition is a rather easy topic to understand – You go to school, you pay for school. It is fairly straight-forward. Yet, it is important to understand that tuition costs tend to change each year. For example, according to College Board’s research, tuition costs raised by 11% for the 2015-16 school year.

Source: College Board

Consult with the financial aid teams within the school you are attending in order to find accurate information regarding your upcoming tuition costs. This will allow you to allocate your budget accordingly.

Create A Segmented Budget

Of course, as adults, we should already have a budget lined up. However, many of us fail to create a segmented budget; causing us to easily lose control of our financial stability. Segmenting, or categorizing your budget will help you understand your spending and save whenever possible. To get started, separate your budget into two categories –I call them: locked and unlocked. You can call these whatever you would like, it is only important that you know the difference.

Locked: The “Locked” section of your budget is your monthly expenses that do not change. Expenditures such as rent, bills, car loans, and savings would fall into this category. These monthly expenses will be the same (or very close to the same) on a month-to-month basis.

Unlocked: The ”Unlocked” section can be a bit more tricky. This section covers the more sporadic side of your spending. Things like: food, clothing, or concert tickets would fall under this category. While it is hard to put an exact number on these expenses, it is equally important to include them within your overall budget.

Understand the Need for Saving

The need to save money was one of the hardest realizations I have come to in my adult life. It is important to understand the age-old saying: life happens. This statement couldn’t be truer.

Building up a savings account can be a deciding factor in how your future will pan out. What happens if your car breaks down? Or your refrigerator suddenly goes out? Speaking from experience, these are incredibly real events, and these events can set you back exponentially in the world of financial control. You need to save.

The ideal savings plan is to set aside 10% of your monthly income. That means, if you are making $1500 per month, you should be putting at least $150 of that away each month. That is $75 per pay check. That is not too bad of a sacrifice, considering the alternatives.

Overall, financial stress is very apparent throughout the college world, but it is important to not be afraid of it. Do not let your finances stop you from having fun. Just be smart!

Want to see what sort of financial aid you could receive from different colleges? Enter your information into our college match tool and see how much you could save!

| Lender | Rates (APR) | Eligibility | |

|---|---|---|---|

|

5.34%-15.96%* Variable

3.99%-15.61%* Fixed

|

Undergraduate and Graduate

|

VISIT CITIZENS |

|

4.92% - 15.08% Variable

3.99% - 15.49% Fixed

|

Undergraduate and Graduate

|

VISIT SALLIE MAE |

|

4.50% - 17.99% Variable

3.49% - 17.99% Fixed

|

Undergraduate and Graduate

|

VISIT CREDIBLE |

|

6.00% - 13.75% Variable

3.99% - 13.75% Fixed

|

Undergraduate and Graduate

|

VISIT LENDKEY |

|

5.50% - 14.56% Variable

3.69% - 14.41% Fixed

|

Undergraduate and Graduate

|

VISIT ASCENT |

|

3.70% - 8.75% Fixed

|

Undergraduate and Graduate

|

VISIT ISL |

|

4.99% - 16.85% Variable

3.47% - 16.49% Fixed

|

Undergraduate and Graduate

|

VISIT EARNEST |

|

5.00% - 14.22% Variable

3.69% - 14.22% Fixed

|

Undergraduate and Graduate

|

VISIT ELFI |