Photo by Tax Credits

Student loan payments are like that friend who can’t get the hint and sticks around way after the party is over–except, instead of 20 or 30 excruciating minutes, they last about 10 excruciating years.

Of course, there are trade-offs between paying more on your loans (having less money now) but paying them off sooner, versus having extra spending money each month but paying on your student loans for a longer period of time. But if there are ways to pay off your loans more quickly without breaking the bank, then you’d probably be interested.

Surely, you want to get rid of them sometime before you’re 50, right?

That’s why we put together this guide to managing your money and knocking your loans out in just 5 years–about half of what it takes for most people to pay off their student loans.

Rather than putting together a list of drastic cost-cutting measures where you throw every available dime at your student loans, we decided to come up with some simple ways that you could save a bit of money each month and put it toward your loans in a way that would pay off big time over the course of 5 years.

Student loan parameters

If we assume that you have “average” student loans, that roughly means:

Total loan amount: $30,000

Repayment period: 10 years

Interest rate: 6%

Monthly payment: $333 (approx)

Let’s do the math

So, what would need to happen in order for your 10-year student loans to be paid off in 5 years? Would you need to double your payment? Not quite.

Because of the way interest compounds periodically, you wouldn’t need to double your payment to cut it in half. Instead, you’d need to add about $246 to your loan each month to make it happen–meaning you’d be paying $579 per month instead of your original payment.

Target monthly payment: $579

But, that’s before you make any changes to lower your student loan payment each month, which you should definitely take advantage of before you start to throw extra money at your loans.

Lowering your student loan payment

The first step to paying off your loan as quickly as possible is to take advantage of some of the ways that you can quickly and (relatively) easily reduce your payment. This will reduce the amount you need to pay extra each month in order to pay off your student loans in 5 years.

1. Refinance your loans

Est. savings: $20 per month / $240 per year

Total savings: $1,200 over 5 years

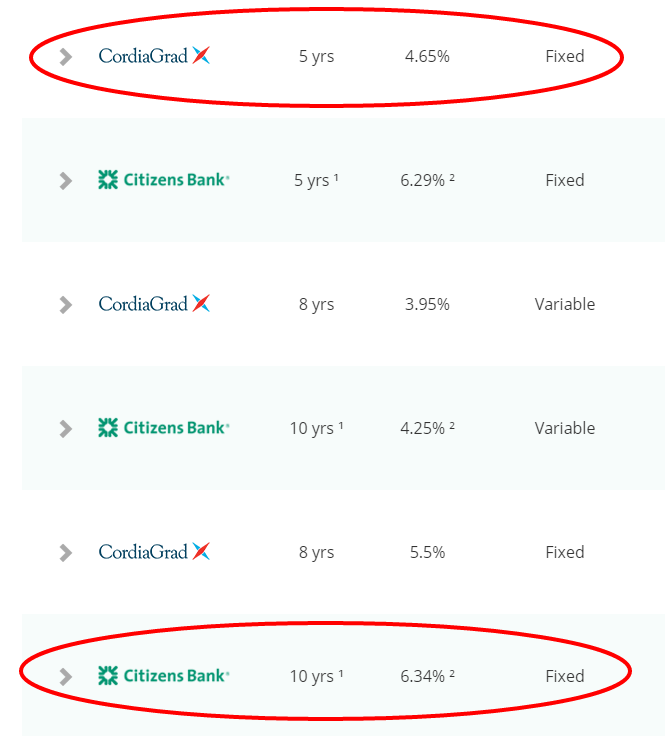

Student loan refinance offers from Credible.com

If you’re committed to paying off your loans in 5 years, refinancing can help to reduce your interest rate and let you pay off your student loans more quickly without having to make any additional sacrifices.

How will refinancing help? Because most lenders will offer a lower interest rate to borrowers who have a shorter repayment (it’s less risk for them). That lower interest rate means that you pay less each month over the same 5 year period–and pay less interest over time. It’s a win-win for you as a borrower.

In doing some comparison, we found offers in which lenders would give you 1.5% lower interest on a 5-year refinance versus a 10-year. That’s a 25% reduction in interest if you’re going from 6% to 4.5%–enough to save you $20 per month.

Check out Credible.com to quickly get rate offers from about eight lenders and see if you can refi at a lower rate.

2. Take advantage of auto-pay discounts

Est. savings: $4 per month / $48 per year

Total savings: $1,040 over 5 years

Want a free reduction in your student loan bill? Set up autopay.

Almost every lender will offer an incentive for you to allow them to automatically withdraw your payment from your bank account each month. Generally, it’s something like .25% lower interest rate. This may not seem like a ton, but it can add up over time.

3. Make two payments every month

Est. savings: $555 per year

Total savings: $2,775 over 5 years

One little-known secret to paying off student loan debt more quickly is to pay twice per month rather than once per month. Not as in making double payments, but as in splitting your payment in half and paying every two weeks.

From a budget perspective, this should be pretty painless–you’re basically spending the same amount, but it helps you out in two ways:

- You’re making one extra payment per year without even noticing it

- Depending on how your interest accrues, you could be reducing the amount of interest that gets added on each period

Note: As this may not actually reduce your monthly payment, I am not going to include it in the cost-savings calculations, but it’s a good tactic to use and will end up shaving months off the end of your loan.

Finding extra money every month

So far, we’ve managed to trim a total of $24 off our monthly loan payment, which means that our actual 5-year repayment is down to $555.

New target monthly payment: $555

If you’ve done everything you can to reduce your student loan payment each month, then it’s time to figure out how to come up with the extra money you need each month in order to make your higher payment and pay off your student loans sooner rather than later.

In this case, we are going from a monthly payment of $333 to paying $555 per month. So, we need to figure out how to come up with an extra $222 each month.

Target savings: $222 per month

To do this, I’ve put together a list of (mostly) pain-free ways that you can scrape together some extra cash each month, which can then be applied directly to your loans.

Take advantage of each of these and you should have enough extra cash to off-set the higher monthly payment and get your loans paid off in 5 years.

1. Carpool to work

Est. savings: $32 per month

You’re sick of driving every day anyway, right?

If you set up an arrangement with a co-worker to carpool into the office each day, you could essentially cut your fuel use in half for your drive to work. (Imagine that you alternate driving each day, or you could also just split gas costs.)

Assuming that driving to and from work makes up a good chunk of your gas usage–say, 40%–and you spend the average of about $38 per week on gas, this would mean that cutting your gas expense in half could save you about $8 per week ($38 * 0.4 * 0.5) just by hitching a ride every other day. Not a bad deal.

2. Split a meal twice a week

Est. savings: $80 per month

If we assume that you spend $10 on average per meal (including home-cooked and restaurants), then cutting out two of those meals per week would save you about $20.

If we assume that you spend $10 on average per meal (including home-cooked and restaurants), then cutting out two of those meals per week would save you about $20.

You shouldn’t skip meals, of course, but you could make one meal turn into two by splitting it up twice per week.

It’s super simple: Twice per week, each time you get a meal (again, whether at home or out), immediately split it into two portions–one for now, one for later. You’ve just doubled your investment–that’s a pretty good return.

This time-tested tactic used by dieters to help with portion control can also help you pay off your student loans more quickly.

If you’re in a relationship or often eat out with friends, you could do a similar approach by sharing a meal and splitting the cost.

3. Order water at restaurants

Est. savings: $32 per month

![a glass of water by [cipher] How to pay off your student loans in 5 years: order water instead of a drink.](https://www.collegeraptor.com/wp/wp-content/uploads/2016/01/3221986177_8e8f395a06_glass-of-water.jpg)

Photo by [cipher]

Instead, just consider your choice of drink each time you’re at a restaurant or order delivery. Do you opt for a soda? That probably costs you about $2, which seems trivial, until you consider how quickly that adds up.

At $2 per soda and 4 meals per week, that’s $8 per week spend on just restaurant sodas when you could get water for free. There’s an extra $32 per month to put toward your student loans.

4. Share a Netflix account

Est. savings: $9 per month

The rules regarding sharing your Netflix service are a bit gray, but it’s pretty common knowledge that many people already take part in this practice. Sharing your account with friends or family is actually pretty easy, and the service generally works for 2-4 devices streaming simultaneously, depending on which tier you pay for.

This may be a pretty simple way to save a few bucks without parting with your Orange Is the New Black or House of Cards.

5. Negotiate cable/internet bills

Est savings: $20 per month

Believe it or not, you hold a lot of power over your cable and internet provider.

Believe it or not, you hold a lot of power over your cable and internet provider.

In most cases, companies will do just about anything to keep you as a customer, even if it means offering you a nice discount on your monthly bill to stop you from switching.

One easy way you can save some money every month is to call and negotiate your rate, you’ll be surprised at how easily you can knock $20 off your bill. It may come in the form of a temporary promotion, but what’s to stop you from repeating the process once your discount expires?

6. Adjust / Program your thermostat

Est savings: $12 per month

One of the most often overlooked ways to save money is to simply have a better understanding of how your thermostat works–whether it’s a programmable thermostat or a manual one.

Making small adjustments can lead to big savings in your energy bill each month. Studies have found that most Americans could save 5-15% on their energy bills by simply adjusting their thermostat and making use of programmable features.

7. Buy in bulk

Est savings: $166 per month

Photo by David McKelvey

For the price of a membership–about $50 per year–you can enjoy the benefits of shopping at a membership club like Sam’s Club or Costco.

It’s common knowledge that these discount stores often offer cheaper prices in exchange for bulk purchases. But, recent studies have found that you could save around $2,000 per year just by taking advantage of these cheaper prices. That’s a lot of wiggle room in your budget!