The financial aid equation

You can run but you cannot hide. It’s time to face the finances.

Before you get into the details of how and when to apply, it’s important to have some basic understanding of how the system works. I promise that it’s not as gruesome as you fear. In fact, the underlying principle upon which the financial aid system is based is surprisingly simple:

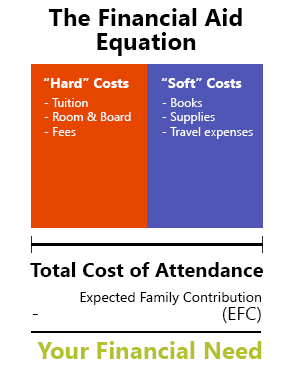

Cost of Attendance minus Expected Family Contribution = Your Financial Need

Your financial need is calculated by subtracting your Expected Family Contribution from the Total Cost of Attendance.

Looks simple, now for the English translation.

COA = Cost of Attendance, or what it costs to go to a particular school. Cost of Attendance has two main parts: hard costs and soft costs.

Hard costs + Soft costs = Cost of Attendance (COA)

The hard costs are the fixed charges like tuition, fees, room and board (or T,F,R,B). You can look on virtually every school’s website (or search here on College Raptor) and find these hard costs in mere minutes.

The soft costs are other expenses you will incur but which vary from student to student. These include books, supplies, travel, and personal expenses. Because these amounts vary widely, schools pick an average amount to use. College Raptor’s cost calculations also try to estimate these costs, but, again they may vary by student.

For most students and schools, it’s safe to use a figure in the $1500 per year neighborhood. If you know you’re traveling across the country for college, you may want to factor in higher costs for a lot of travel. But, at this point, it’s more important for you to understand the concept than the specific soft cost amount.

Understanding Expected Family Contribution (EFC)

The next element in our equation is EFC, or Expected Family Contribution, (aka what your family is expected to contribute to your child’s education). It is not, however, what YOU think you can contribute, it’s what Uncle Sam thinks you can contribute, and that, as you may surmise, may or may not have any relationship to what you think is realistic.

In order to get an EFC (and hence to be eligible for any type of federal, state and institutional financial aid), families must file the FAFSA (Free Application for Federal Student Aid). This form cannot be submitted before January 1st of the year in which the student will enroll in college. FAFSA deadlines vary by school, yet it only gets submitted once per year, so it’s really important to know the earliest deadline by which the FAFSA must be filed. That’s the date from which you must work. Many institutions (particularly private ones) have deadlines in February for prospective students.

Filing the FAFSA is significantly easier if you have completed your tax return prior to completing this application. If you’ve done your taxes, much of the FAFSA is simply a matter of looking up the referenced line on your taxes and filling in the blanks…mostly.

If you have to meet a February filing deadline, having your taxes completed may have the same odds as defying Newton’s law of gravity, so onto Plan B.

The easiest Plan B option is to take your last completed tax return and your W-2 or final paystub for the year and try to estimate your current year taxes, taking out the old income information and replacing it with the current year. The two numbers often don’t differ significantly. The FAFSA will give you the ability to indicate that the figures you’re submitting are based on estimates and you will (relatively painlessly) be able to update them once the actual numbers have been established.

The FAFSA gets submitted online at www.fafsa.ed.gov. Using the online application allows for faster processing and ease in submitting changes/corrections. Using the online application will let you know if the form has been submitted correctly and gives you your Expected Family Contribution (EFC) on your confirmation page immediately upon submission.

Financial aid in practice

Okay, so you’ve jumped through the hoops, done a little math, and now you’re trying to figure out: What does all of this mean when I actually choose a college?

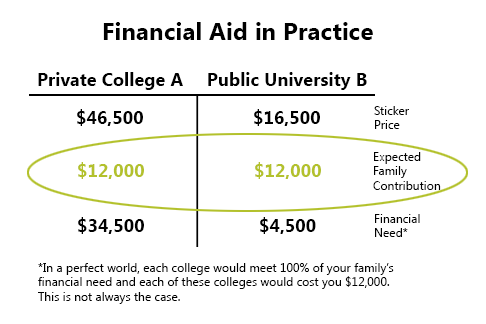

Imagine that you have two colleges you’re considering:

In this example, the colleges *should* cost the same, because the EFC remains the same. Many colleges, though, will not meet a family’s full financial need, which means that their net price is higher than their EFC.

Private college A which costs $45,000 for tuition, fees, room and board (plus another $1500 for books, supplies, etc.) for total Cost of Attendance of $46,500

Or

Public University B which costs $15,000 for tuition, fees, room and board (plus $1500) for a total COA of $16,500.

In a perfect world, you would pay the same $12,000 to go to either school, despite the huge difference in sticker price. Because your EFC is the amount that you’re expected to pay for college based on your income information, it doesn’t change based on the cost of college (although there are different ways to calculate EFC, generally they are not wildly different).

In reality, that may or may not be the case.

It is the job of each school to fill all—or as much as possible—of your financial need. They are under no obligation to meet 100% of your demonstrated financial need, and you will often find that financial aid packages from multiple colleges will result in different bottom lines.

I call this the hurry up and wait game; you do all of this work up front to get in your FAFSA and submit your application, and then you wait until you receive all of your financial aid packages before you see what you would really owe at each college.

Frustrating? Yes. But, it’s the system we have to work with and you can get through it. So, take a deep breath, and keep reading.

Understanding and comparing your college financial aid award letters

You work feverishly to ensure that you file your financial aid applications by the all-important deadlines, and then you…hurry up and wait.

Weeks later, you will receive financial aid packages from all of the schools to which you’ve submitted the requisite paperwork and to which you’ve been accepted. With any luck, the amount of financial aid you are offered will be just one variable in making a decision about where you will attend college, albeit a very important one for many families.

Your next job is to compare these packages so that you understand both the bottom line and the desirability of the component parts of the financial aid package.

It is the college’s job to prepare your financial aid package; however, it is important to know that they are under no obligation to meet all of your financial need. So, the first step in evaluating financial aid packages is to determine who gives you the most money?

Do not, however, stop there. Even if the amount of money is the same from different schools, the kind of aid you receive may be different in each package.

Optimizing gift aid is often the best option for families that are looking to spend the least amount out of pocket or in loans for college.

There are 2 main categories of financial aid that a college will offer your family:

- Gift Aid

This includes: Scholarships which are based on some talent or academic performance and Grants (a need-based gift based on FAFSA results).Many families think that outside scholarships are where they can get the most money to pay for college, but the reality is that the huge majority of “free” money for college comes from federal programs and gift aid provided by the college itself. This is extremely important.

- Self Help Aid

This includes loans—money that is borrowed and must be repaid—and work options (like work study programs and other campus jobs).

Obviously, optimizing gift aid is ideal, because it’s “free” money to you.

The only strings attached to this money are that you may have to maintain a certain GPA or participate in an activity for which the money was intended. Gift aid may not cover enough of the college costs to allow you to foot the bill (that would be what is known as a “full-ride”), so some self help aid may be a realistic necessity. The good news is that funds earmarked for college loans are often much more favorable than that available to the non-student and federal loan programs offer low interest rates and different repayment and forgiveness programs that a student may be eligible for after graduation.

Look past the total amount of aid and examine exactly how much of your financial aid package is made up of gift aid and how much is loans or work programs that you’ll need to either repay or earn through a paycheck.

You can find a financial aid award letter comparison tool to help you compare your actual financial aid award letters on the College Board’s website.

Financial aid forms: FAFSA and CSS Profile

So, in the alphabet soup of college financial aid, you (hopefully) learned that the grand-daddy of financial aid acronyms is the FAFSA or Free Application for Federal Student Aid (www.fafsa.ed.gov). Every school uses the FAFSA in determining and awarding financial assistance for college.

Through the personal and financial information provided on the FAFSA, the federal government determines what they think you are able to pay toward college costs. The amount the government thinks you can pay is called the Expected Family Contribution (EFC) and is subtracted from the school’s cost of attendance to determine your financial need. (Remember, Cost of Attendance – Expected Family Contribution = Need.) It is then the college’s job to meet all or as much of that need as possible, and voila, a financial aid package is born.

For some colleges, however, the FAFSA’s voyeuristic view of your family finances isn’t enough information. Hard to believe, huh?

So, for those compulsive collectors of financial minutiae, CSS (College Scholarship Service) created The CSS Profile . The Profile financial aid application is used almost exclusively by private colleges who give out millions of dollars of their own grant funds (i.e. “gift” that does not need to be repaid). The Profile asks almost every conceivable financial question, closing every possible loophole and leaving no stone unturned about the places from which a family might have income or assets.

While filing the FAFSA may be slightly less enjoyable than passing a kidney stone, completing the Profile is a lot like a double root canal with no anesthesia. These college financial aid applications are, however, necessary evils. So I recommend that you dish out a scoop of your favorite ice cream, get into a comfy chair with some soothing music to calm your nerves, and get the job done.

While the FAFSA will not cost you anything to file (hence the “Free” in Free Application for Federal Student Aid), no such luck with The CSS Profile. Filing The CSS Profile will cost $25, and every school to which you want the data released will cost you an additional $16. So, while you should list every college to which you want to be considered for financial aid on the FAFSA, you should list ONLY the schools that require The CSS Profile on that application form.

Occasionally you’ll find a college that requires both the FAFSA and their own institutional financial aid application, but not the CSS Profile. In their attempt to avoid having you pay to file the CSS Profile, they’ve added another application form into the mix. Some colleges might ask you for a copy of your tax returns and W-2’s before they’ll prepare a financial aid package for you, some will only want these documents if you choose to enroll, and some schools won’t want them at all.

How do you stay sane and find all of this information? You now become part consumer and part detective. Each school’s financial aid filing requirements are listed on the school’s website, usually at a link from the school’s admissions site. It’s cumbersome, challenging and frustrating, but essential with a potentially big payoff.

| Lender | Rates (APR) | Eligibility | |

|---|---|---|---|

|

5.34%-15.96%* Variable

3.99%-15.61%* Fixed

|

Undergraduate and Graduate

|

VISIT CITIZENS |

|

4.92% - 15.08% Variable

3.99% - 15.49% Fixed

|

Undergraduate and Graduate

|

VISIT SALLIE MAE |

|

4.50% - 17.99% Variable

3.49% - 17.99% Fixed

|

Undergraduate and Graduate

|

VISIT CREDIBLE |

|

6.00% - 13.75% Variable

3.99% - 13.75% Fixed

|

Undergraduate and Graduate

|

VISIT LENDKEY |

|

5.50% - 14.56% Variable

3.69% - 14.41% Fixed

|

Undergraduate and Graduate

|

VISIT ASCENT |

|

3.70% - 8.75% Fixed

|

Undergraduate and Graduate

|

VISIT ISL |

|

4.99% - 16.85% Variable

3.47% - 16.49% Fixed

|

Undergraduate and Graduate

|

VISIT EARNEST |

|

5.00% - 14.22% Variable

3.69% - 14.22% Fixed

|

Undergraduate and Graduate

|

VISIT ELFI |