Source: 401kcalculator.org

When it comes to the cost of college, there are a lot of myths out there. Many times, these myths can scare students and families away from colleges that might have been very affordable, or even cost that family thousands of dollars in lost financial aid opportunities.

Understanding how both the cost of college and financial aid work can not only help families feel less confused and overwhelmed by college, it can literally change their student’s life–financial aid often opens up opportunities that would have never been possible otherwise.

Here are 5 of the most pervasive myths about the financial aid of college that every parent should know:

1. Most colleges are way out of my price range

All of the talk about the price of college can be intimidating. And, this can be made even worse when you look at a college’s website and see a price tag of $45,000 or $60,000.

These schools may seem way out of reach for your family–but chances are pretty good that they’re not.

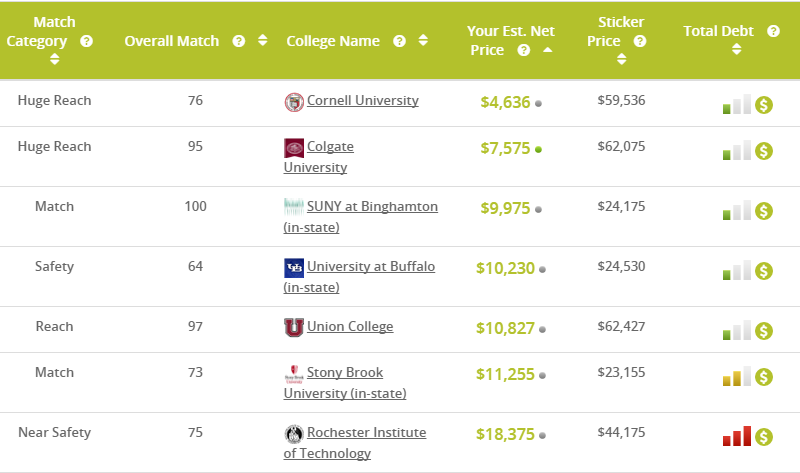

The key is that you look at the net price of college — that is, the cost after grants and scholarships — rather than the “sticker” price. What you’ll often find is that schools you thought cost $45,000 or $60,000 may be much more affordable, and even cost less than state schools, in many cases.

Using College Raptor, you can quickly and easily get an estimate of your net price at any 4-year college in the U.S. (Shown below)

The bottom line: Don’t be scared away by the “sticker” price!

2. Financial aid is only for poor students

Certain types of financial aid are reserved for the poorest families. But, definitely not all of them!

In fact, most families (even upper-middle class families) can qualify for need-based financial aid, depending on their family situation.

If we look at statistics, we can see that a huge percentage of students qualify for financial aid, so it is definitely not only for “very poor” families.

In addition to this, many students — not just the ones with straight As — can often qualify for generous merit scholarships.

The bottom line: All kinds of students can receive financial aid that could dramatically reduce their costs of college.

3. I don’t need to fill out the FAFSA; I won’t get any financial aid anyway

As I mentioned above, the myth that financial aid is only for the poorest of the poor is simply untrue. Do not, under any circumstances, just assume that your family will not qualify for aid without completing the FAFSA. It may be a pain in the butt, but it’s completely free and could save you thousands if you find out that you do qualify.

But, even more importantly, the FAFSA (and, in some cases, the CSS Profile) are absolutely critical to qualifying for grants and scholarships that come directly from colleges.

Your family is even more likely to qualify for these institutional scholarships, as individual colleges meet financial need differently. You could find that your college meets 100% of demonstrated need and awards you a $10,000 or $20,000 scholarship–which you would have never received without the FAFSA!

4. The only way to save money on college is to fill out thousands of applications and write hundreds of essays hoping to “win” scholarships

Years ago, it may have been true that for most students the only way to get a scholarship was by “winning” a giveaway from a local business or organization.

But, this is not the case any more. In fact, so-called private or outside scholarships account for just 13% of all forms of gift aid (free money) received by students each year. Nearly three times that amount comes directly from colleges or universities themselves — institutional scholarships for need or merit.

The best way to earn grants and scholarships is simply to shop around. Every college has its own financial aid rules and will offer your student and family different aid depending on your situation.

College Raptor makes it easy to compare estimated aid offers from every 4-year college so your family can determine which schools may offer you the “best deal”.

5. My family could never afford to pay for an Ivy League education

This myth doesn’t only apply to Ivy League schools, but it’s most pervasive when looking at the most expensive schools in the country. After all, how the heck do families afford to pay $60,000 per year to send their kid to Harvard?

The answer: Most of them don’t!

In fact, Harvard would cost less than a state school for 90% of the U.S. population, according to their website.

How could this be? Again, every college has its own financial aid rules. And, many of the most expensive and most prestigious colleges and universities also have plenty of money to use for financial aid and tend to meet most of their students’ financial need.

To repeat my point from earlier, the key here: Don’t be scared away by the sticker price!

Ivy League schools may not be for you, but this point is true for any school. Don’t sell yourself (or your student) short by assuming that colleges are out of your price range without first exploring what your net price will be.

If you have a gap to fill, use College Raptor’s free Student Loan Finder to compare lenders and interest rates side by side!

| Lender | Rates (APR) | Eligibility | |

|---|---|---|---|

|

5.34%-15.96%* Variable

3.99%-15.61%* Fixed

|

Undergraduate and Graduate

|

VISIT CITIZENS |

|

4.92% - 15.08% Variable

3.99% - 15.49% Fixed

|

Undergraduate and Graduate

|

VISIT SALLIE MAE |

|

4.50% - 17.99% Variable

3.49% - 17.99% Fixed

|

Undergraduate and Graduate

|

VISIT CREDIBLE |

|

6.00% - 13.75% Variable

3.99% - 13.75% Fixed

|

Undergraduate and Graduate

|

VISIT LENDKEY |

|

5.50% - 14.56% Variable

3.69% - 14.41% Fixed

|

Undergraduate and Graduate

|

VISIT ASCENT |

|

3.70% - 8.75% Fixed

|

Undergraduate and Graduate

|

VISIT ISL |

|

4.99% - 16.85% Variable

3.47% - 16.49% Fixed

|

Undergraduate and Graduate

|

VISIT EARNEST |

|

5.00% - 14.22% Variable

3.69% - 14.22% Fixed

|

Undergraduate and Graduate

|

VISIT ELFI |

My daughter was Valedictorian of her class and got a 34 on the ACT. She got WAY more money for school from Vanderbilt than the University of TN, and she is a TN resident! Anchor down!