In this guide, we’ll go over the following questions:

- What’s the difference between refinancing and consolidation?

- Why should I refinance my student loans?

- How much do interest rates affect my loan cost?

- When is the best time to refinance?

- How do I refinance?

- Is refinancing right for me?

- What are the benefits of consolidating my loans?

- When should I consolidate?

- How do I consolidate my loans?

- Is consolidating right for me?

- How do I get the best deal on refinancing / consolidation?

Student loan refinancing and student loan consolidation are popular methods of saving money or managing loan payments. But how do they work? Should you consolidate and refinance student loans? What are the pros and cons? We’ll answer all that and more in this guide.

What is the Difference Between Student Loan Refinance and Consolidation?

First, some basics.

- Refinancing: Refinancing your student loans means that you simply take out a new loan and use the money to pay off your existing loan. This means you will get a new interest rate and new loan terms.

- Consolidation: Student loan consolidation is the act of taking multiple student loans and combining them into one single loan. Consolidating means one monthly payment and one set of loan terms.

Reasons to Refinance Your Student Loans

Let’s start with refinancing. There are a number of reasons to refinance your student loans, including:

- Lowering interest rates

- Lowering monthly payments

- Changing loan term length

Lowering Interest Rates

Perhaps the biggest benefit of refinancing is earning a lower interest rate. By making payments on time with your current loan, you are developing a credit history. With more established credit, lenders are more willing to lower your interest rate. In other words, you can save a ton of money in the long run. Interest can add up fast to the total cost of the loan.

Lowering Monthly Payments

Let’s say you’re struggling with the amount of your current monthly payments. Refinancing can help to lower the cost to a more manageable level. Making payments on time will help you avoid defaulting. However, lowering the monthly payment will more than likely extend the total life of the loan.

If you’re eager to pay off your student loan, you can shorten its lifespan. Consider increasing your monthly payments. The quicker you pay it off, the more money you save.You’ll be out of debt sooner. However, reducing the length of your loan will likely increase your monthly payments.

The Importance of Interest Rates

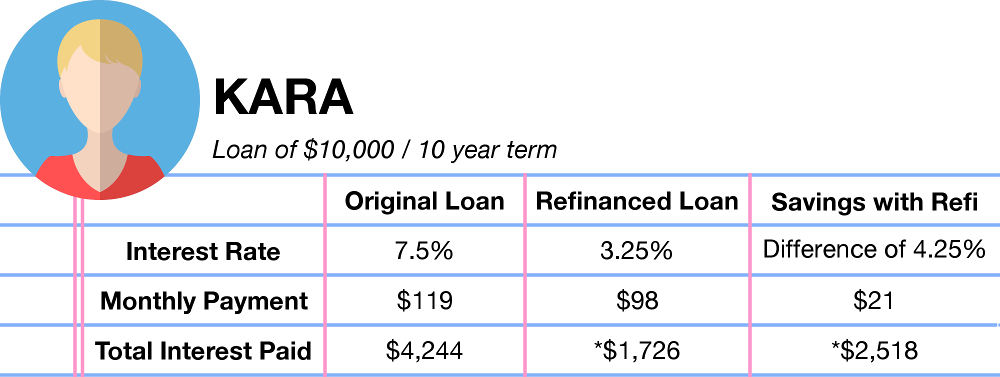

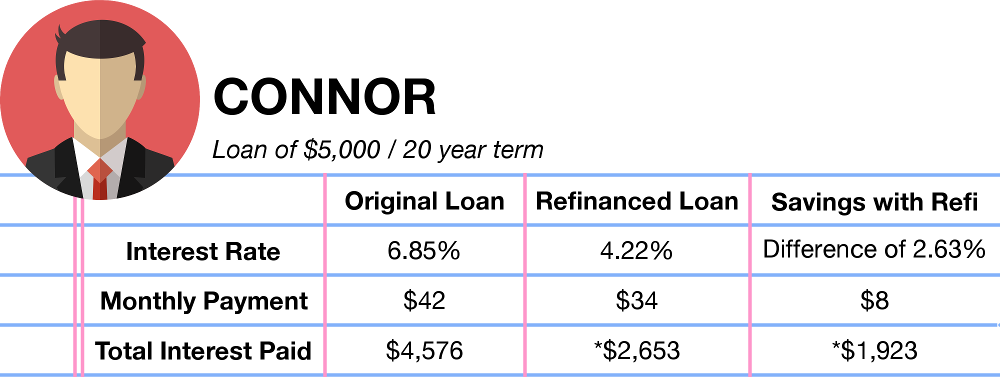

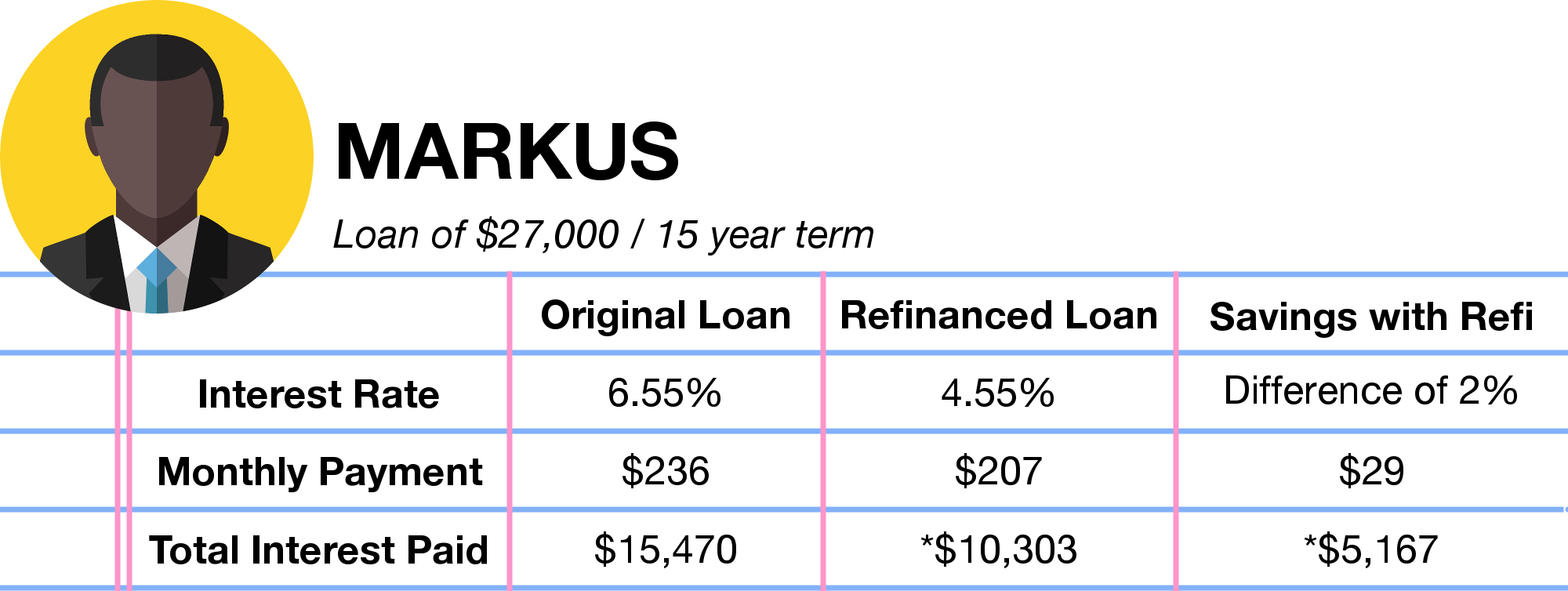

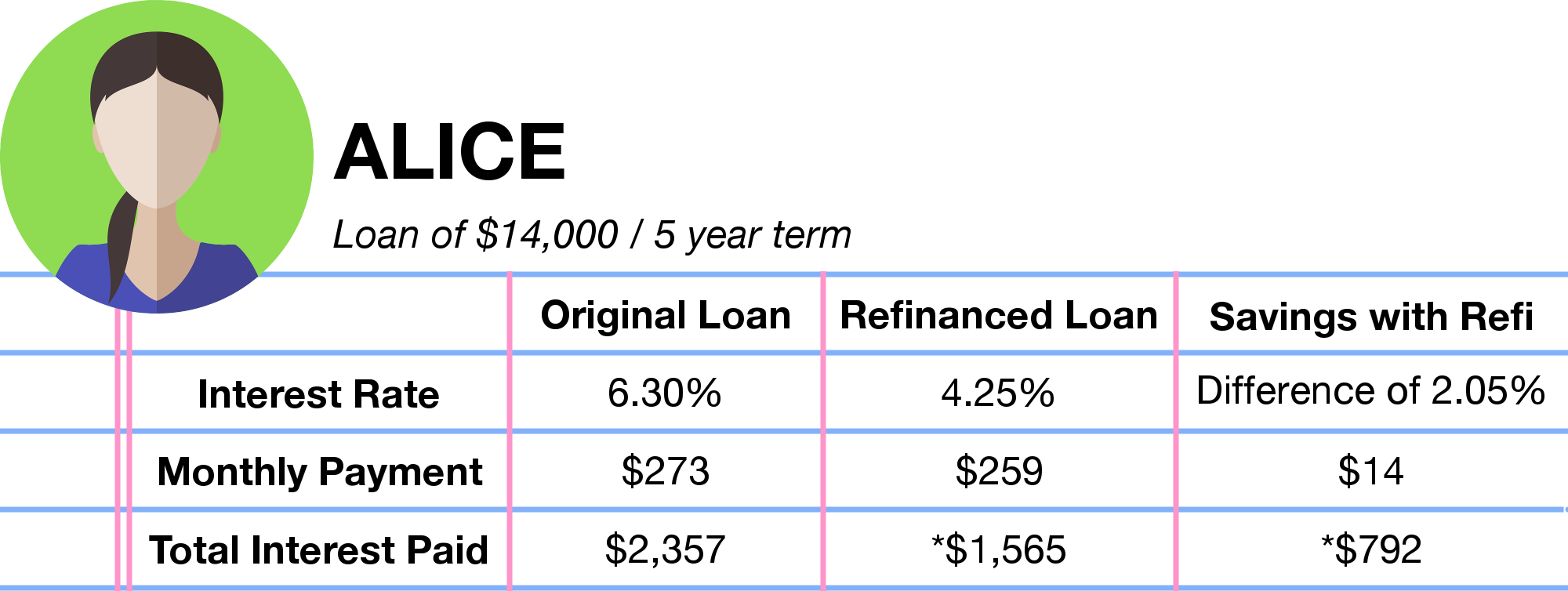

A lower interest rate sounds all well and good. But, how much does it actually impact your student loan? We want to really emphasize how much an interest rate can affect the total cost of a loan. Let’s take a look at these examples.

*Note: “Total interest paid” and “savings” will depend entirely on when you refinance the loan. Keep in mind, these numbers are meant to highlight how much an interest rate will affect the total cost of the loan, rather than actual calculations of potential savings.

When to Refinance Your Student Loans

Despite the fact that you can refinance whenever you want, there is a best time to refinance student loans. It’s after you’re earning a stable income, made a few successful repayments, and managed to build your credit history. Subsequently, lenders often offer better interest rates to borrowers who meet these three requirements. The earlier you refinance your loans at a lower rate of interest, the more you will save in interest payments.

However, this can take a few months to a year after graduation. You have to wait till you have a steady income and time to improve your credit score. You may find it difficult to refinance immediately after graduation. Even if your request is approved, you could pay a much higher rate of interest. Unfortunately, it may not be worth it in the end.

How to Refinance Your Student Loans

Refinancing can only be done through a private lender. First, you need to decide which lender to go through. It’s important to shop around to look for the best rates and terms. Compare several before settling on one.

Refinancing Federal Loans

The federal government doesn’t refinance federal loans. You can refinance and consolidate federal loans through a private lender. However, you will lose any and all benefits associated with the original loan. That includes any student loan forgiveness or income-based repayment plans. Above all, be sure to understand what your current benefits are so you don’t make an unwise switch.

Refinancing Private Loans

When it comes to refinancing your student loans, you usually go through a traditional credit check. You may need a cosigner to qualify if you haven’t had time to establish good credit yet. However, this could save you a lot on your monthly payments. Additionally, it can secure you more favorable terms—like a lower interest rate.

Refinancing Federal & Private Loans

If you have both federal and private loans, you can refinance them both at the same time. But remember: refinancing your federal loans means you will lose the benefits associated with them. That includes flexible repayment plans and certain loan forgiveness options. Generally speaking, federal loans tend to have lower interest rates. If you choose to refinance, make triply sure you’re getting better rates or terms before signing.

Is Refinancing Right for You?

So, now you know all about refinancing. Ask yourself these questions before you decide to refinance your student loans:

- Am I looking for a lower interest rate?

- Do I want a shorter repayment period?

- Am I looking for lower monthly payments?

- Am I willing to give up federal benefits for any of the above?

- Do I have good enough credit / can I build better credit?

- Do I have a steady income?

If you can comfortably answer “yes” to the majority of these questions, you might be ready to refinance your student loans.

Reasons to Consolidate Your Student Loans

Now onto consolidation! There are several potential benefits when you consolidate your student loans into one:

- One single monthly payment

- One set of loan terms

- Easier to manage your loan

One Monthly Payment

Keeping track of multiple student loan payments can be a headache. Missing a payment by even a day could potentially make you default, or harm your credit score. Consolidating your loan means remembering one single payment per month. It makes things a lot easier to keep track of!

One Set of Terms

Each loan you took out likely had their own rules and terms. They may even be with different lenders. By consolidating your loans, you’ll receive one set of terms for the whole thing. This may mean that your interest rate, repayment period, and other conditions change to fit your new loan.

Easier to Manage Your Loan

Given that you’ll have one monthly payment and one set of terms, a consolidated loan makes life a lot easier. You don’t have to worry about juggling a bunch of details for different loans. Consolidating is a great way to stay on top of your student loan payments. It also helps you avoid accidentally missing anything and winding up in student loan default.

Given that you’ll have one monthly payment and one set of terms, a consolidated loan makes life a lot easier. You don’t have to worry about juggling a bunch of details for different loans. Consolidating is a great way to stay on top of your student loan payments. It also helps you avoid accidentally missing anything and winding up in student loan default.

When to Consolidate Your Student Loans

Like refinancing, the best time to consolidate your student loans is after you’ve built a good credit history, made several successful repayments, and are earning a stable income. This can earn you a lower interest rate when you consolidate your loans. Therefore, right after graduation may not the best time to consolidate. Additionally, if you’re close to paying off your loans, there’s not a major benefit to consolidating.

How to Consolidate Your Student Loans

Depending on the loan source, you can either consolidate through the government or a private lender.

Consolidating Federal Loans

Unlike refinancing, federal loans can be consolidated. Federal Consolidation Loans merge multiple federal student loans into a single loan. The interest rate of a Federal Consolidation Loan will be the average interest rate of your federal loans. Depending on your loan rates and amounts, you could reduce your rate. Also, it’s definitely more convenient and less stressful.

While most federal loans are eligible for consolidation, a few are not. For example, the Parent PLUS Loan isn’t eligible. There are a couple of other drawbacks as well. Consolidating federal loans can strip them of federal benefits. You can lose benefits like a grace period or forgiveness.

However, you can choose to consolidate some, but not all, of your federal loans. This is an ideal option for students who want to minimize their stress but maintain certain federal benefits.

Consolidating Private Loans

With private loan consolidation, there is no one rule governing eligibility or requirements. Every lender has their own stipulations regarding consolidation. Some lenders may require you to borrow a minimum amount to qualify. Others may assess your creditworthiness before approving of your consolidation application. Since there are many options, shopping around is strongly encouraged.

One potential benefit is that you could qualify for a lower rate of interest with your consolidated loan.

Consolidating Both Federal and Private Loans

Not all private lenders give you the option to consolidate federal and private student loans. However, there are some that will—like Laurel Road. Bundling both types of loans together can save you money in the long-run. It will also likely help you secure a lower interest rate for the combined loan amount. (Remember, you will lose federal loan benefits if you consolidate through a private lender).

Is Consolidation Right for You?

Great, you’ve learned about consolidation! Ask yourself these questions before consolidating:

- Did I take out multiple student loans?

- Do I have a steady income?

- Am I finding it difficult to stay on top of my payments?

- Do I have good credit / can I build good credit?

- Am I having a hard time keeping track of my various loan terms?

- Do I want a lower interest rate?

- Do I want lower monthly payments?

- Am I willing to give up federal benefits for any of the above?

Did you answer “yes” to a majority of these questions? Definitely consider consolidating your loans.

How to Pick the Right Student Loan Lender to Consolidate and Refinance Your Student Loans

Of course, you want to pick the right lender and getting the best deal. We recommend evaluating potential lenders. Below are the criteria before you consolidate and refinance student loans:

- Interest Rates

- Loan Terms

- Repayment Flexibility

- Application Process

- Customer Service

- Borrower Protections

Interest Rates

When deciding whether to consolidate and refinance student loans, look at the interest rates. The first thing you’ll want to know about a potential refinancing lender is what interest rates they will offer you. A great rate could save you tons of money on your student loans. In addition, it can lower your monthly payment and make it easier for you to pay off your loans.

Repayment Flexibility

If you do decide to consolidate and refinance student loans, choosing the terms of your repayment can be intimidating. Should you commit to paying more each month in order to pay them off more quickly? Or, should you spread out your repayment schedule to have some wiggle room?

Ultimately, this decision depends on your financial situation. However, having flexible options can be a lifesaver. Especially if your situation changes or you need to adjust your payment schedule later.

Application Process

You’ve nailed down the specifics of refinancing your student loan. However, you still have to apply, be approved, and receive the funds. Some lenders have an easier process than others. All will require a credit score and current loan information. Do some research before you consolidate and refinance student loans.

Customer Service

We’ve all heard horror stories about terrible customer service from student loan lenders. Student loans are already stressful enough. In that vein, you don’t want to shoddy customer service on top of that. Ask and look for lenders who are friendly, responsive, and helpful. Overall, it’ll save you a lot of headaches while trying to consolidate and refinance student loans.

Borrower Protections

As a general rule, it’s nice to have a backup plan whenever possible. Many lenders offer protections against unemployment or other financial hardship. That can help you in case you’re having trouble making your student loan payments.

That’s a lot of things to compare and contrast when deciding whether or not to consolidate and refinance student loans. Fortunately, College Raptor’s already done all that for you. We’ve picked six of the best lenders out there. See the below table for student loan consolidation and refinance companies.