Photo by 401k Limits

If you’re a borrower with student loans, then there is one thing that many people would consider to be the most important aspect of your debt: the interest rates.

Although it’s often not well understood by borrowers, the interest rate on your loan plays a huge role in multiple aspects of your student loans. Your interest rate can affect how much you pay over the life of your loans, how quickly you pay off your loans, and even what options are best for you when looking to reduce the cost of your loans.

The interest rate is basically one of two main levers that dictate the terms of your loans (the other is the repayment period).

This guide will teach you about how interest works and why you should care–a lot–about the rate that you’re paying. You’ll learn:

- What is an interest rate?

- How interest rates work (accrual and capitalization)

- Why interest rates matter

- How to know if you’re getting a “good” interest rate

- How to get a better interest rate

- The difference between Variable vs Fixed interest rates

What is an interest rate?

The interest rate of your student loans is the fee that borrowers pay to the lender that gave them the money. It’s how banks and other lending institutions make money.

As a borrower, it means that you not only pay back the original amount that you borrowed, but also an additional amount is added to each payment to cover the cost of interest. For most borrowers, this additional rate is somewhere between 2-10%.

In general, a lower interest rate is better–it means you are paying less to borrow the money. But, there are some other considerations to take into account.

How interest rates work (accrual and capitalization)

Interest rates “accrue”–or, add up. Every day or month, your interest is calculated for a pro-rated time period, based on the accrual period and interest rate. This accrual is not added to the balance of the loan, but it instead comes due with the next payment.

So, for example, if your student loan balance is $10,000 and you have a 5% interest rate. If your interest accrues once per month, you would owe about $42 in interest.

$10,000 * 0.05 = $500

$500 / 12 months = $42 in interest

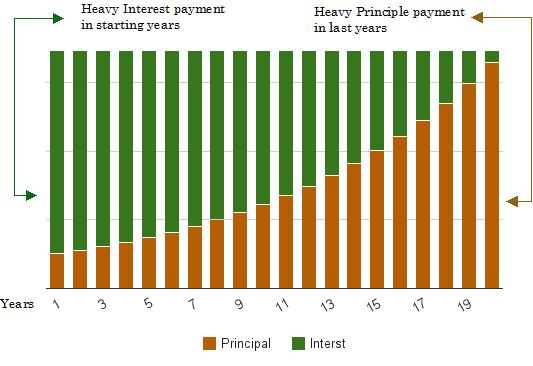

Usually, when a borrower makes a payment on their loan, they will first pay any interest that has accrued. Then, the remaining amount will be used to pay down the principal balance of the loan.

If you make a monthly payment of $150, then $42 will pay off the accrued interest and the remaining balance of $108 will come off of your principal. Now, you owe $9,892.

$10,000 principal + $42 interest = $10,042 owed

$10,042 – $150 = $9,892 (new principal)

The following month, when your interest accrues, it will be 5% of the new principal balance. This means that the amount of interest that you pay each month will decrease over time as long as you make a payment more than the amount of the interest that was due.

Example of a loan amortization table. Source

This means that a higher percentage of your payment each month will go toward paying off the principal balance, rather than paying off accrued interest.

Interest can also “capitalize”–or, be added to the principal balance–if it goes unpaid. This means that future interest amounts will increase, rather than decrease, over time.

To use the above example, if you were to make a payment of only $20, then the remaining $22 in interest that had accrued would capitalize. Instead of owing $10,000, you would end up owing $10,022.

This is why it’s important to at least pay the accrued interest on your loan. Otherwise, the interest compounds and can dramatically increase your debt amount over time.

Why interest rates matter

As you can probably tell from the above examples, the rate of interest that you pay can make a huge difference on how much you pay not only each month, but also how much total interest you pay over time.

Small changes–like 1 or 2%–in your interest rate can add up to thousands or tens of thousands of dollars over the life of your loan, depending on how much you’ve borrowed.

Compare these interest rates to see the difference:

| Original balance | $35,000 | $35,000 | $35,000 |

|---|---|---|---|

| Repayment terms | 10 years | 10 years | 10 years |

| Interest rate | 3% | 5% | 8% |

| Monthly payment | $337.96 | $371.23 | $424.65 |

| Total interest paid | $5,555 | $9,574 | $15,958 |

| Total paid | $40,555 | $44,574 | $50,958 |

This example illustrates why it’s critical for borrowers to not only understand their interest rate, but to also get the best rate possible in order to save thousands of dollars on their student loan debt.

How to know if you’re getting a “good” interest rate

Has this guide sufficiently scared you into wondering if you’re actually getting a good deal on your interest rate or overpaying?

Well, good!

The first step to taking control of your student loans (and possibly saving a bunch of money) is taking stock of your current situation and figuring out where you stand.

As a general measure, your student loan interest rates generally are closely tied to mortgage rates. So, if you’re paying more than today’s mortgage rates, it may be time to investigate your options.

But, you can also get customized rate estimates from companies like Credible and Lendkey for free–without a credit check.

That way, you can learn quickly if you might qualify for a lower rate based on your specific loans and circumstances.

Getting a better interest rate

If you’re on the market for a better rate, then there are a few things to know.

Factors that affect your interest rate may include:

- Credit score/history

- Student loan payment history

- Degree/academic achievement

- Current and future earnings

- Savings habits

Many lenders perform a traditional credit check and base their rates on credit scores, but a company like Earnest refinances student loan debt with an alternative underwriting process that considers a broader range of factors than traditional credit checks.

Variable vs Fixed interest rates

After doing your research and identifying a lender that offers you a better interest rate, then your next question is likely: variable or fixed interest?

Many lenders offer the option for borrowers to choose either a fixed-rate interest (interest rate remains the same for the life of the line, unless it’s refinanced) or a variable-rate interest (interest rate fluctuates and can change up to once every X-number of days, based on market rates).

Choosing which one is right for you is generally an exercise in risk analysis–do you mind risk or no?

Variable rates can save you a bunch of money if interest rates are low and stay low. Or, rates end up dropping over the life of your loan to a rate that’s below fixed.

But, there is market volatility involved. It’s impossible to know exactly how rates will change in the coming years.

As a general rule, if you want to avoid risk, then you may want to choose a fixed-rate loan. If you’re more interested in saving money and variable rates are low, then you may want to choose a variable rate loan. You could possibly refinance in the future if rates rise.

Lastly, the shorter the repayment period on your loan balance, the more appealing variable rate loans should seem. Market rates generally do not fluctuate much over short periods of time.

Other factors (besides interest rate) to consider

Although interest rates are an incredibly important aspect of your student loan, it is not the only thing to consider.

When finding the right loan for you, you’ll want to take into account the whole loan, including:

- Repayment period

- Customer service/support

- Borrower protections

- Additional fees or

So, while a lower rate may be better, be careful that it doesn’t come with any strings attached.

| Lender | Rates (APR) | Eligibility | |

|---|---|---|---|

|

6.97%-15.03%* Variable

5.99%-14.00%* Fixed

|

Undergraduate and Graduate

|

VISIT CITIZENS |

|

6.37% - 16.70% Variable

4.50% - 15.49% Fixed

|

Undergraduate and Graduate

|

VISIT SALLIE MAE |

|

4.98% - 16.70% Variable

4.07% - 15.66% Fixed

|

Undergraduate and Graduate

|

VISIT CREDIBLE |

|

6.07% - 11.31% Variable

4.39% - 10.39% Fixed

|

Undergraduate and Graduate

|

VISIT LENDKEY |

|

6.22% - 16.08% Variable

4.09% - 15.66% Fixed

|

Undergraduate and Graduate

|

VISIT ASCENT |

|

6.54% - 11.08% Variable

3.95% - 8.01% Fixed

|

Undergraduate and Graduate

|

VISIT ISL |

|

5.62% - 18.26% Variable

4.11% - 15.90% Fixed

|

Undergraduate and Graduate

|

VISIT EARNEST |

|

4.98% - 12.79% Variable

8.42% - 13.01% Fixed

|

Undergraduate and Graduate

|

VISIT ELFI |