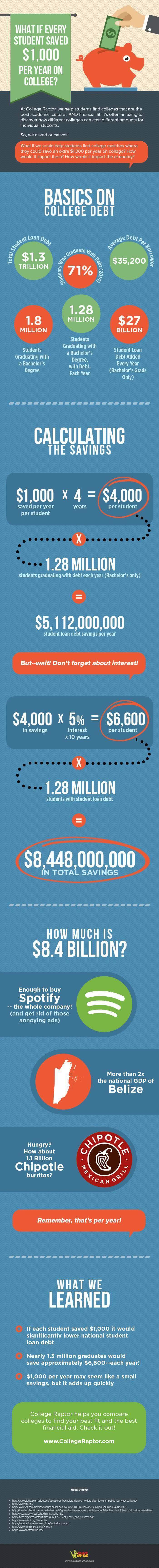

Let’s play a game of “what if” — what if every student (pursuing a bachelor’s degree) got an extra $1,000 per year for four years? Maybe it was through a grant, maybe a scholarship, or maybe books and supplies didn’t cost as much. Whatever the reason, in this hypothetical query each student $1,000 — a thousand less in loans certainly sounds good, right? Our research shows that this simple “what if” game has a lot of implications, especially when looking at savings on a national scale. $1,000 may not seem like much with such daunting student loan totals looming overhead, but it packs more of a punch than you might think.

So how can one grand worth of savings affect anything in the grand scheme of things? Simple, with if the 1.28 million students graduating with debt every year all save just that much, it really adds up. The amount of student loan debt avoided is shocking. It also really gets you thinking — what could we do with all that potential extra money? How much is it exactly? Our little hypothetical question certainly has a big snowball effect.

In this infographic, we’ll explore the effects that saving a grand has on student loan debt, individual finance, and national savings — including how interest rate has a big role to play. Additionally, you can learn about some averages and statistics when it comes to the number of loans taken out per student, how much student debt there is nationally, and what percentage of students graduate with debt. Our findings show both the short and long term effects of our “what if” question. Take a look to learn how even $1,000 worth of savings can affect individual students as well as the whole economy. The results just might surprise you.

| Lender | Rates (APR) | Eligibility | |

|---|---|---|---|

|

6.97%-15.03%* Variable

5.99%-14.00%* Fixed

|

Undergraduate and Graduate

|

VISIT CITIZENS |

|

6.37% - 16.70% Variable

4.50% - 15.49% Fixed

|

Undergraduate and Graduate

|

VISIT SALLIE MAE |

|

4.98% - 16.70% Variable

4.07% - 15.66% Fixed

|

Undergraduate and Graduate

|

VISIT CREDIBLE |

|

6.07% - 11.31% Variable

4.39% - 10.39% Fixed

|

Undergraduate and Graduate

|

VISIT LENDKEY |

|

6.22% - 16.08% Variable

4.09% - 15.66% Fixed

|

Undergraduate and Graduate

|

VISIT ASCENT |

|

6.54% - 11.08% Variable

3.95% - 8.01% Fixed

|

Undergraduate and Graduate

|

VISIT ISL |

|

5.62% - 18.26% Variable

4.11% - 15.90% Fixed

|

Undergraduate and Graduate

|

VISIT EARNEST |

|

4.98% - 12.79% Variable

8.42% - 13.01% Fixed

|

Undergraduate and Graduate

|

VISIT ELFI |