Students can transfer schools for all sorts of reasons –another college has a better program, they weren’t clicking with the environment, etc.– but whatever the cause, all transfer students face similar challenges with their move. Whether it’s financial or academic — what’s the real cost of transferring colleges?

The benefits of transferring colleges:

Given the right circumstances, transferring schools can be an incredibly rewarding decision. Maybe the student’s current school isn’t challenging enough, maybe their interests changed and the college they’re at doesn’t have the correct major. It could be that the current school is just too expensive, or maybe their interests have matured and changed. Regardless of the reason, another college just might be a better fit. NACAC found that 33% of college students transfer at some point, so they’re certainly not alone.

But there are potential downsides

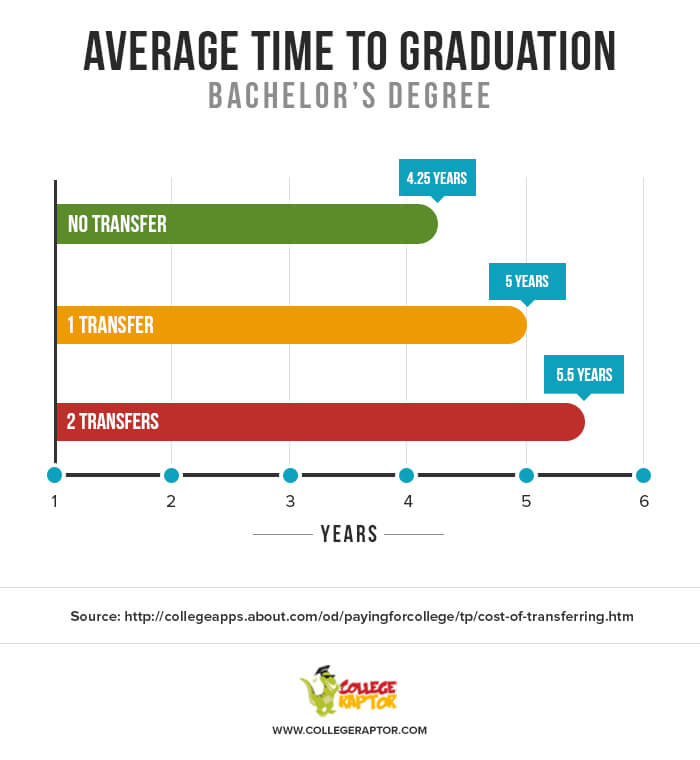

However, since no two colleges are the same, what counts towards credits or requirements at one might not be the same at the other. As such, transfer students can “lose” credits when they move to the new school, and have to make up the loss by adding an extra semester (or several) onto their education. Typically, transfer students have to attend school for an extra year in order to receive a bachelor’s degree that would have taken them only 4 years to earn if they hadn’t switched schools.

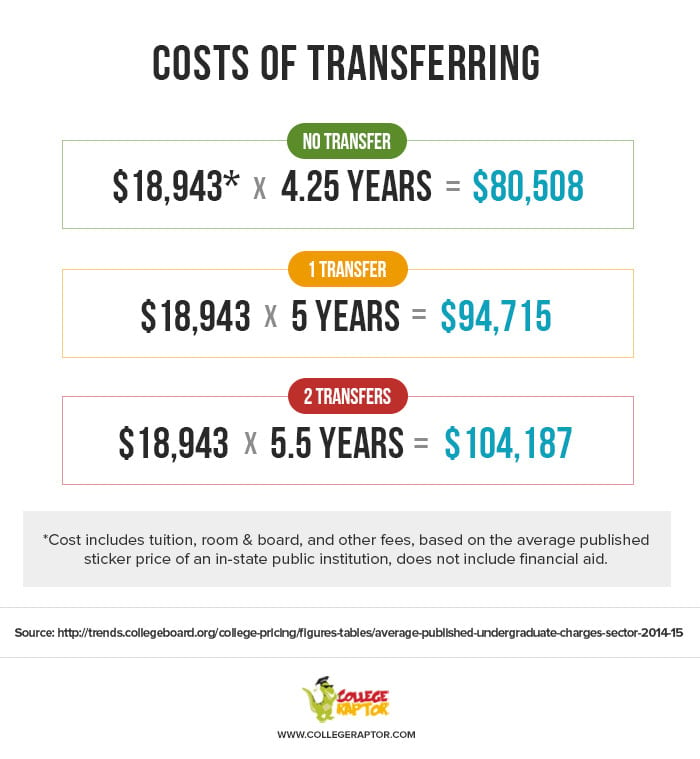

Adding more time can weigh a little heavy on the wallet — another year (or two) means additional semesters of tuition, living costs, and other school expenses. The longer a student is in college, the less time they’re out in the business world, earning enough to start paying loans back.

What are the types of transfers?

There are multiple types of transfers –from a 2-year community college to a 4-year university, from a public to a private college, or from one public 4-year to another– each with different factors that can affect pricing changes. To highlight how much an extra year (or two) might cost, let’s walk through an example. In the 2014-15 school year, the average published cost of attendance at a public in-state 4-year college was $18,943. If a student wanted to transfer to another in-state school, they might find the additional cost surprising.

Take a look below to see the potential cost for the transferring student in the example:

Transferring schools can have as many pros as it does cons — cost being one of the main factors. It’s important to make an informed choice, so students and parents should do as much research as they can before committing to the idea of transferring schools.

All of this isn’t meant to scare you from transferring colleges. As pointed out above, many students transfer–and often for good reason. But, it does underscore the importance of finding the right college fit, which hopefully means you won’t need to transfer schools.

| Lender | Rates (APR) | Eligibility | |

|---|---|---|---|

|

6.97%-15.03%* Variable

5.99%-14.00%* Fixed

|

Undergraduate and Graduate

|

VISIT CITIZENS |

|

6.37% - 16.70% Variable

4.50% - 15.49% Fixed

|

Undergraduate and Graduate

|

VISIT SALLIE MAE |

|

4.98% - 16.70% Variable

4.07% - 15.66% Fixed

|

Undergraduate and Graduate

|

VISIT CREDIBLE |

|

6.07% - 11.31% Variable

4.39% - 10.39% Fixed

|

Undergraduate and Graduate

|

VISIT LENDKEY |

|

6.22% - 16.08% Variable

4.09% - 15.66% Fixed

|

Undergraduate and Graduate

|

VISIT ASCENT |

|

6.54% - 11.08% Variable

3.95% - 8.01% Fixed

|

Undergraduate and Graduate

|

VISIT ISL |

|

5.62% - 18.26% Variable

4.11% - 15.90% Fixed

|

Undergraduate and Graduate

|

VISIT EARNEST |

|

4.98% - 12.79% Variable

8.42% - 13.01% Fixed

|

Undergraduate and Graduate

|

VISIT ELFI |